2024 in Crypto Market

Bitcoin Peaks, Altcoin Innovations, and DeFi’s Bold Comeback

The cryptocurrency market in 2024 has defied historical norms, presenting an evolving narrative fueled by Bitcoin’s shifting cycles, an explosion in altcoin projects, and a revival in decentralized finance (DeFi). This year has been pivotal for the crypto space, driven by technological advancements, structural market changes, and a deeper integration of blockchain into mainstream financial systems.

This detailed analysis is based on insights from K33 Research, and offers a comprehensive look into the trends that defined 2024. From the redefined Bitcoin cycles to the proliferation of altcoins and the resurgence of DeFi, this blog post provides valuable insights for investors, developers, and Web3 enthusiasts. Let’s dive into the transformative events and trends shaping the future of cryptocurrency.

The End of Bitcoin’s 4-Year Cycles: A New Era

Historically, Bitcoin’s price cycles peaked approximately 1,060 days after a halving event. However, 2024 has disrupted this pattern, with predictions of a peak in January marking an 800-day cycle.

This shift is reminiscent of the 2021 bull market, where Bitcoin reached $57,000 in February, earlier than expected. Analysts attribute this phenomenon to increased market efficiency and growing institutional participation, which has accelerated Bitcoin’s price discovery mechanisms.

Example: Bitcoin surpassed its pre-halving all-time highs in late 2023, signaling a deviation from traditional cycle behavior.

Source: K33 Research

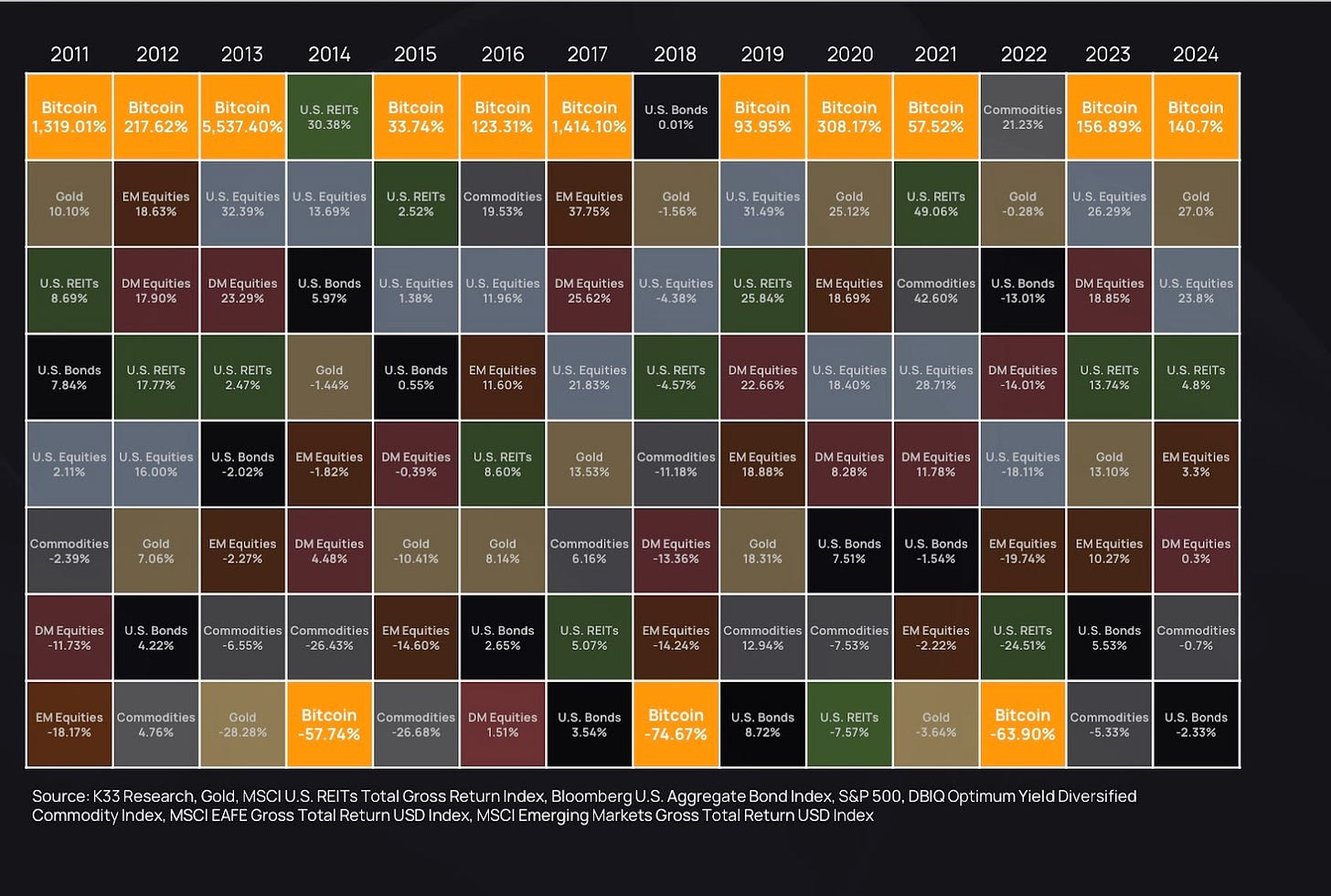

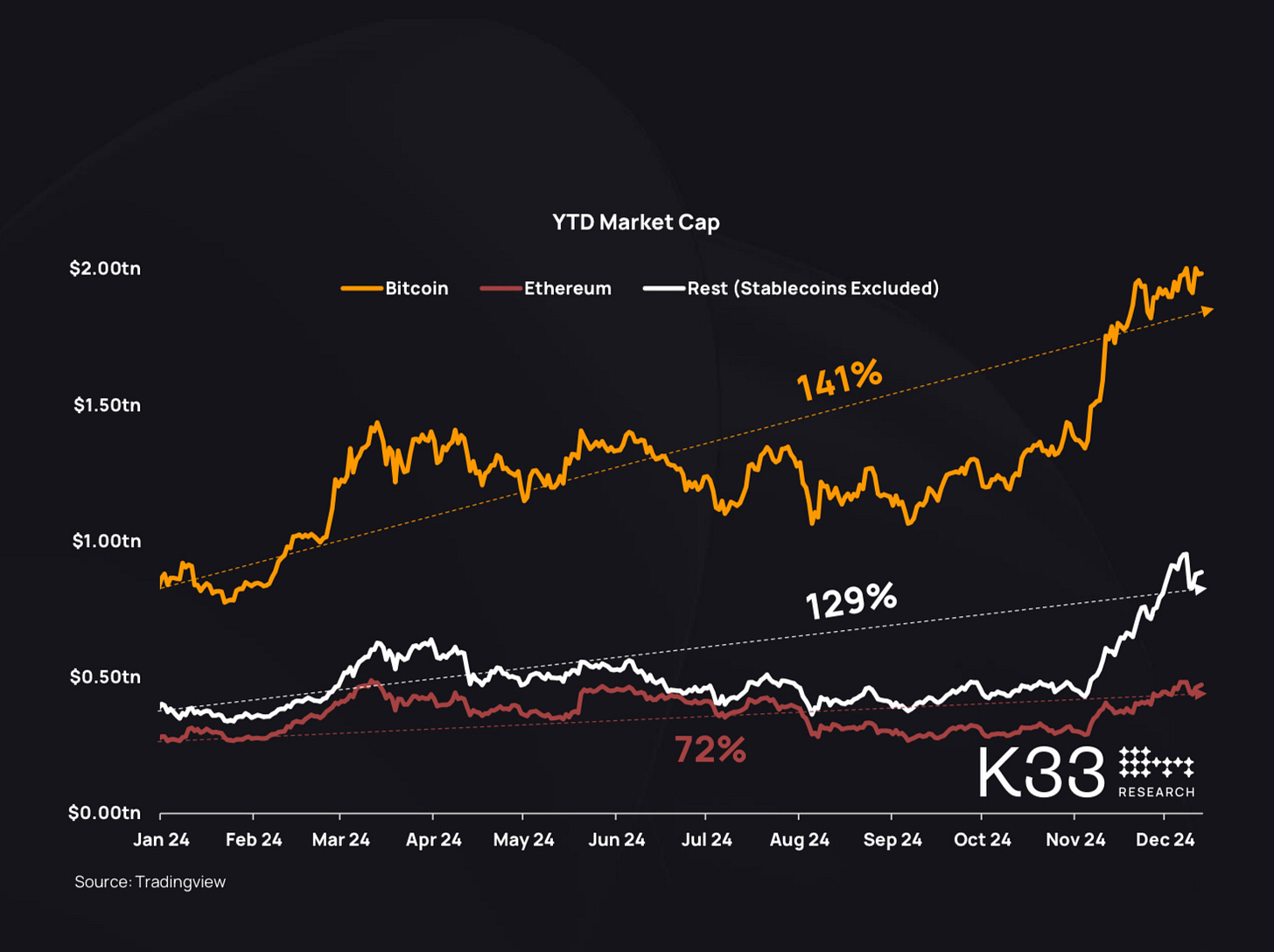

Bitcoin’s year

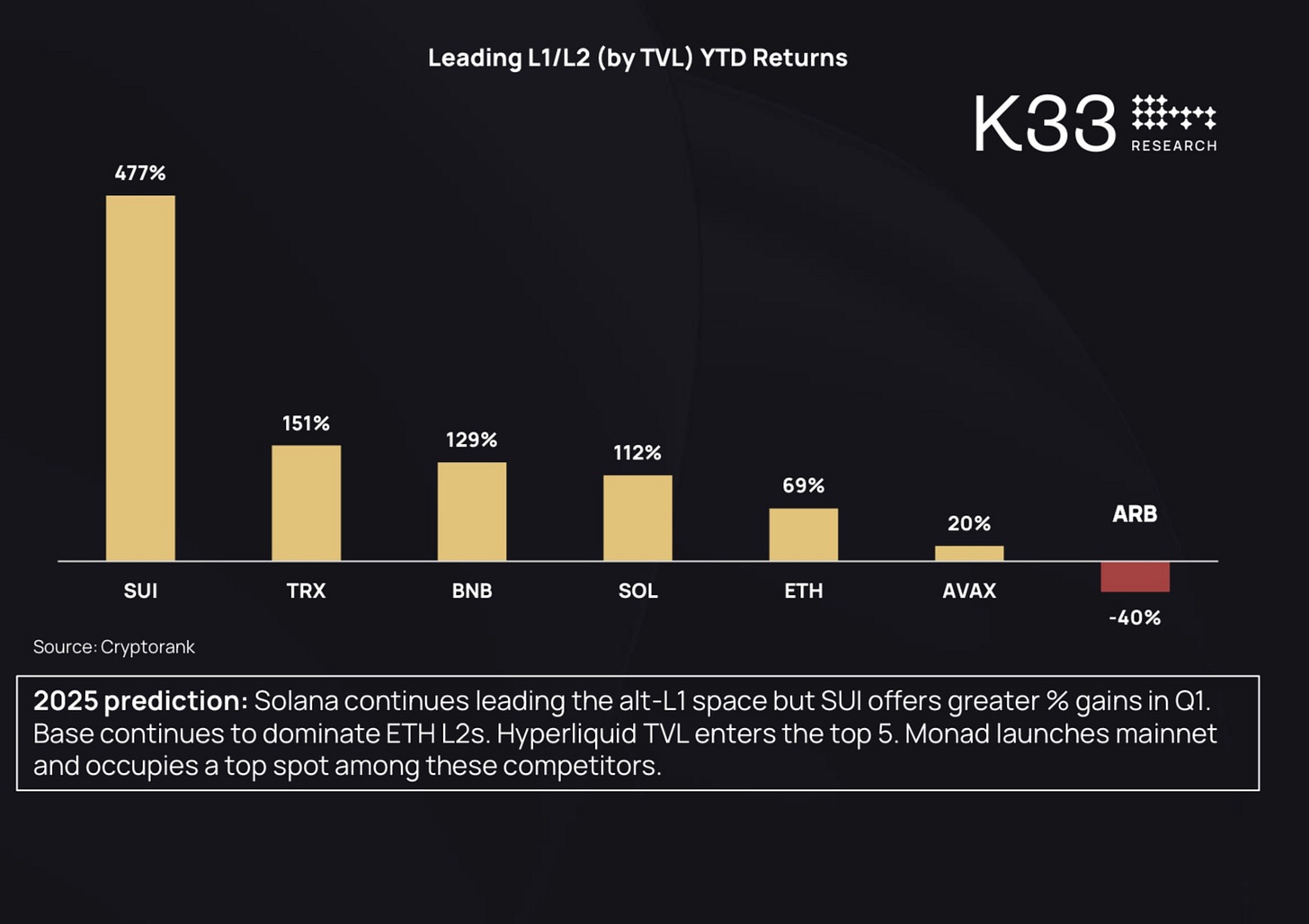

2024 has been bitcoin’s year, most altcoins have underperformed.

▪ Bitcoin’s market cap grew by 139% in 2024 from $828bn to $1.98tn.

▪ Ethereum’s market cap grew by 72% in 2024 from $274bn to $473bn.

▪ The rest of the altcoin market saw its market cap grow by 129% in 2024 from $389bn to $886bn, mainly fueled by SOL and memecoin strength

Source: K33 Research

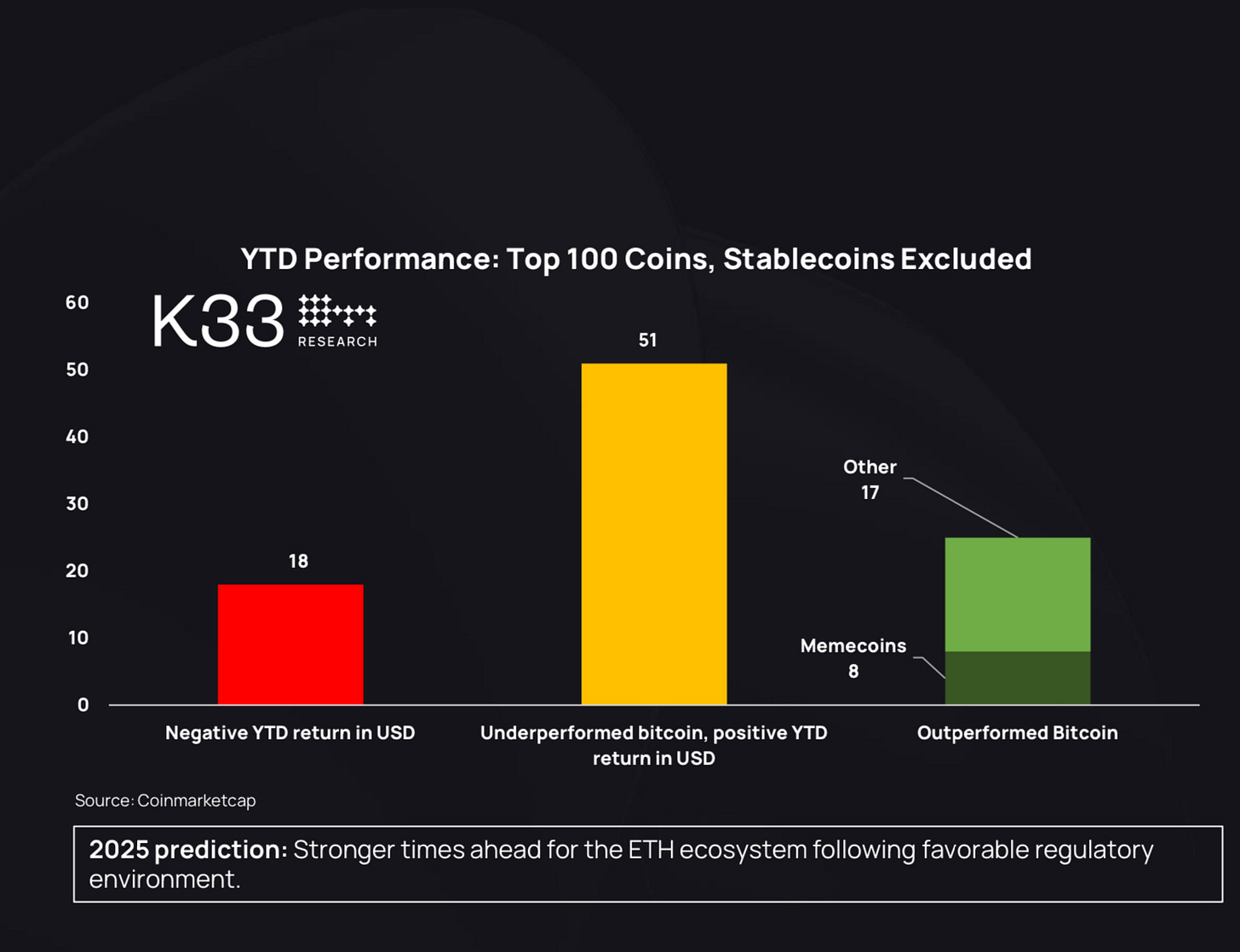

2024 has been bitcoin’s year – major alts struggles.

▪ Only 25 coins among the top 100 coins outperformed BTC in 2024.

▪ 51 coins underperformed BTC but saw positive YTD returns.

Examples: ETH and SOL.

▪ 18 coins among the top 100 saw negative returns in 2024. The worst-performing coins? Layer-2s,

ETH ecosystem.

Source: K33 Research

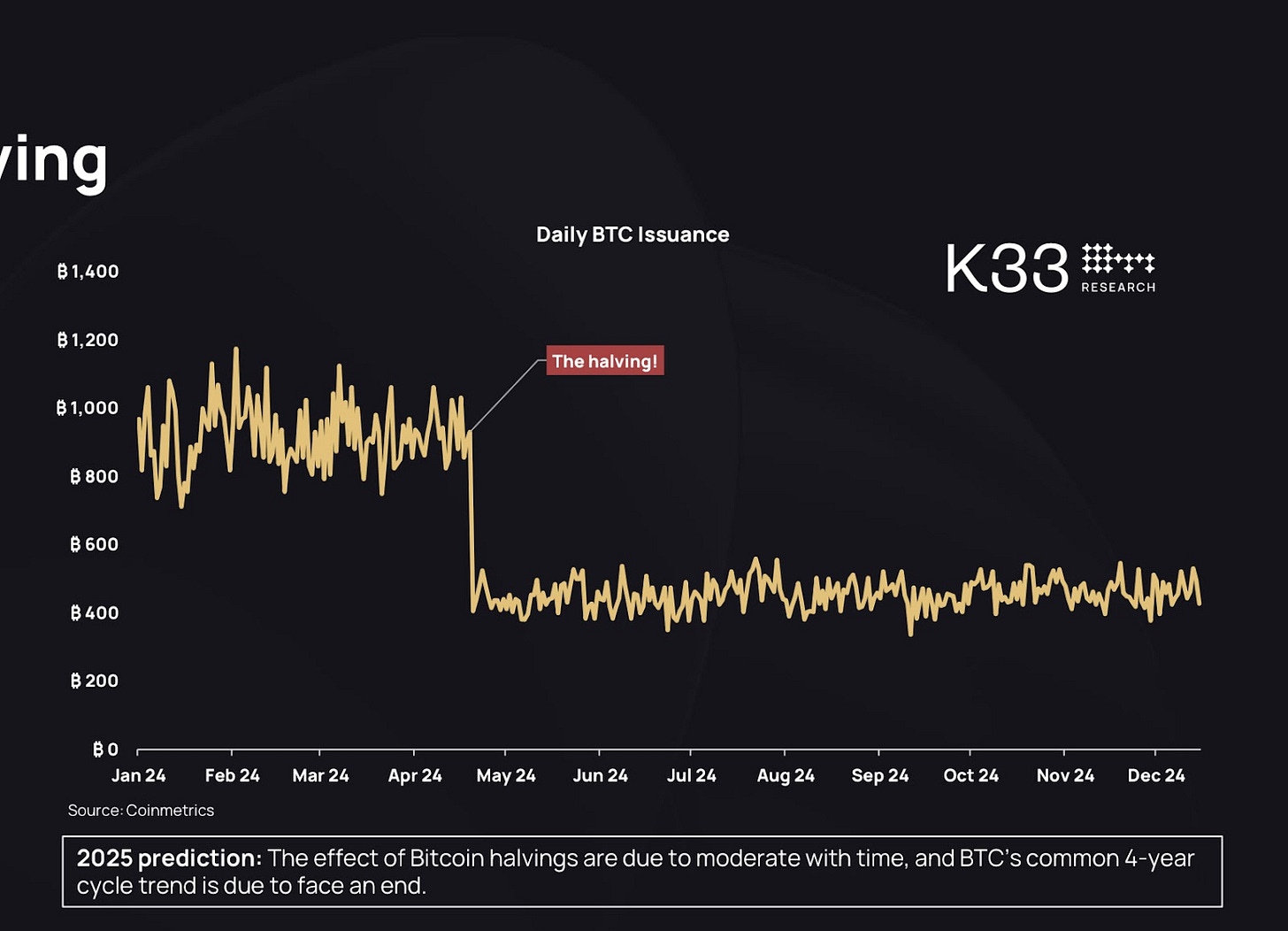

The Declining Impact of Halving Events

While halvings have historically catalyzed bull runs, their influence appears to be waning. The 2024 halving reduced daily Bitcoin issuance to 450 BTC, with an annual inflation rate of just 0.8%. Yet, this reduction is less impactful compared to earlier cycles due to Bitcoin’s increasing market maturity.

Source: K33 Research

Supporting Data: In 2025, Bitcoin’s projected issuance (~164,250 BTC) is less than MicroStrategy’s purchases between November 1 and December 12, 2023, demonstrating how institutional demand now outweighs halving-induced scarcity.

Structural Shifts in Bitcoin Demand

Bitcoin’s demand is now driven by factors beyond its deflationary supply mechanism:

• Institutional Adoption: ETFs like BlackRock’s Spot Bitcoin ETF have introduced Bitcoin to traditional investors.

• Nation-State Participation: Countries such as El Salvador and the Central African Republic continue to adopt Bitcoin as legal tender.

• Increased Financialization: Derivative products and integration into banking systems have expanded Bitcoin’s use case as a store of value.

Bitcoin Price Predictions: Methods and Projections for 2024

The Diminishing Returns Theory

Bitcoin’s price growth has decelerated with each cycle due to its growing market cap.

• 2013-2017: +1,387%

• 2017-2021: +251%

• 2024 Projection: A peak around $146,000, based on the diminishing returns model.

Market Cap Growth as a Price Predictor

Bitcoin’s market cap growth provides another lens for predictions:

• 2013-2017: +$321 billion

• 2017-2021: +$967 billion

• 2024 Projection: A market cap of $4.2 trillion, translating to a price of ~$212,500 per BTC.

Altcoin Market Dynamics in 2024

Source: K33 Research

Adapting Investment Strategies in the Changing Altcoin Market

The altcoin market is dynamic and often unpredictable, with trends like the rise of memecoins, the growth of Layer 2 solutions, and increased focus on real-world utility driving change. Here’s how investors can adapt:

• Diversify Strategically:

Avoid putting all your capital into one project, especially speculative altcoins. Focus on a diversified portfolio that includes:

Established altcoins like Ethereum and Solana, which offer strong use cases and robust ecosystems.

Emerging projects with real-world utility, such as those in decentralized finance (DeFi) or AI-powered blockchain solutions.

• Analyze Utility and Adoption Potential

Evaluate whether an altcoin serves a tangible purpose or addresses a market need.

Example: Projects like Chainlink (decentralized oracles) and Filecoin (decentralized storage) have clear use cases that drive adoption.

Use tools like on-chain analytics platforms (e.g., Glassnode or Nansen) to gauge adoption trends and developer activity.

• Stay Updated on Regulatory Changes:

Regulatory clarity often determines an altcoin’s growth potential. For instance, projects compliant with emerging regulations may attract institutional funding.

Keep an eye on announcements from the SEC, EU regulators, or Asian markets to identify opportunities or risks.

• Plan for Volatility:

The altcoin market is known for extreme price swings. Use dollar-cost averaging (DCA) to invest incrementally and minimize exposure to sudden downturns.

The Rise of Memecoins and Microtokens

Platforms like Pump.fun have democratized token creation, leading to over 4.8 million memecoins being launched. While these tokens capture speculative interest, they also dilute the market and pose sustainability concerns.

Real-Life Example: Pump.fun generated ~$380 million in fees, showcasing the immense revenue potential of memecoin platforms.

Layer-1 and Layer-2 Innovations

Source: K33 Research

Institutional Interest in Altcoins

Institutional interest is shifting beyond Bitcoin and Ethereum to include Layer-1 networks like Avalanche and niche Layer-2 projects.

Real-Life Example: Fidelity and other asset managers have begun offering investment products tied to a diversified basket of altcoins.

The Return of DeFi: Growth, Challenges, and Innovations

DeFi’s Role in Crypto Market Recovery

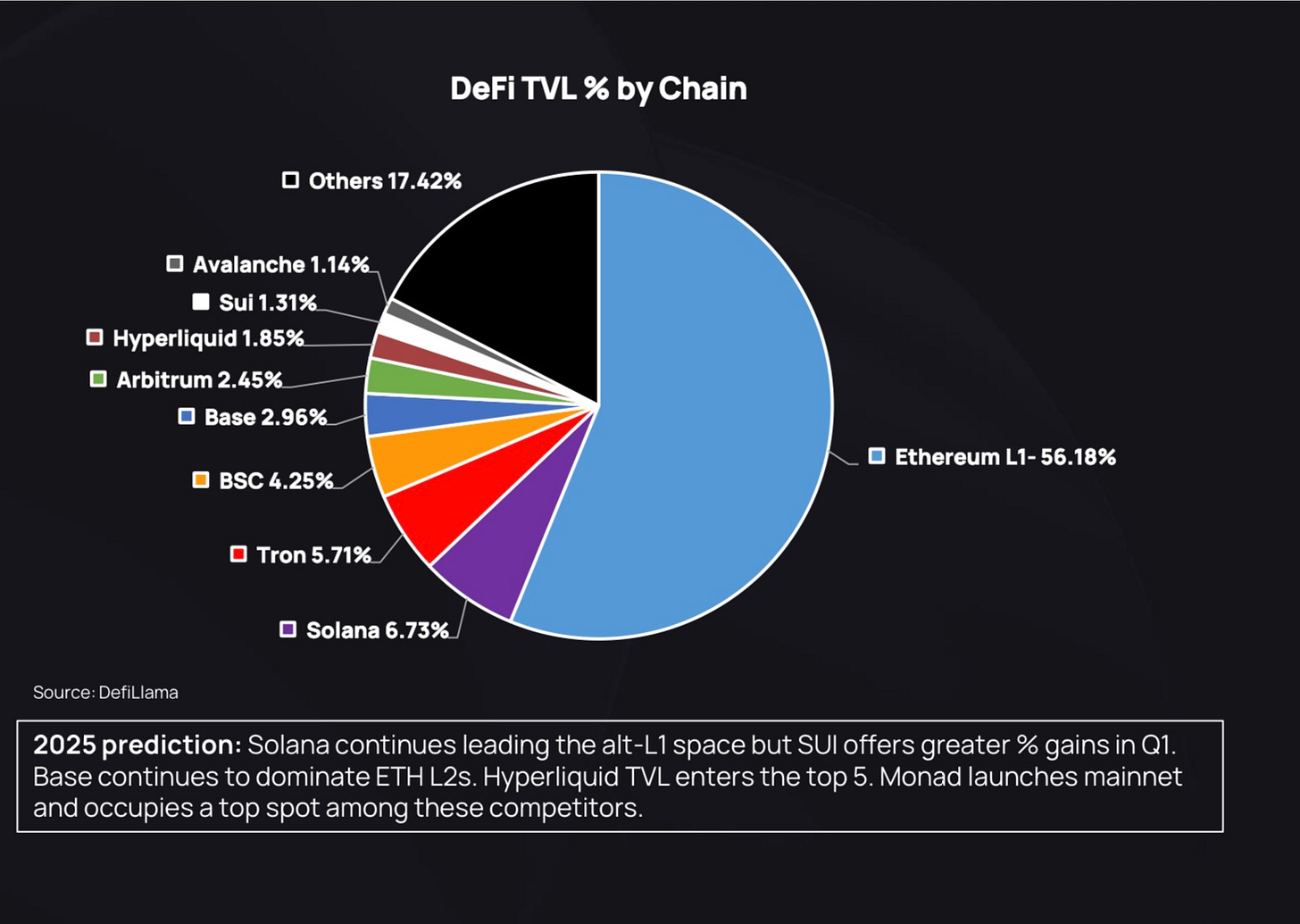

Decentralized Finance rebounded strongly in 2024, with Total Value Locked (TVL) reaching $137 billion, a 152% increase from 2023. This growth is attributed to lower interest rates, improved UX, and innovative yield strategies.

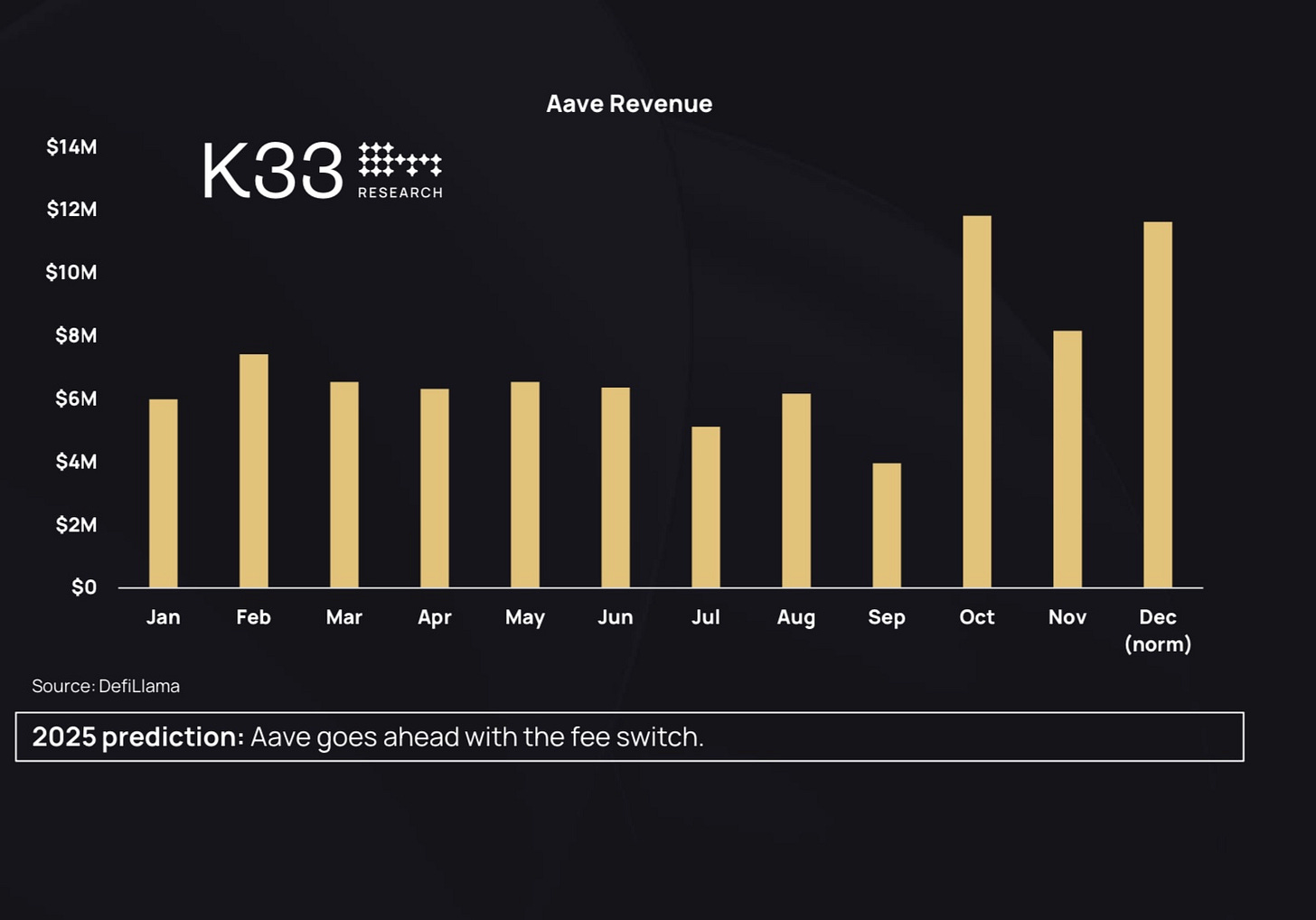

Example: Aave and Compound saw record revenue in Q4 2024, driven by increased lending and borrowing activity.

Source: K33 Research

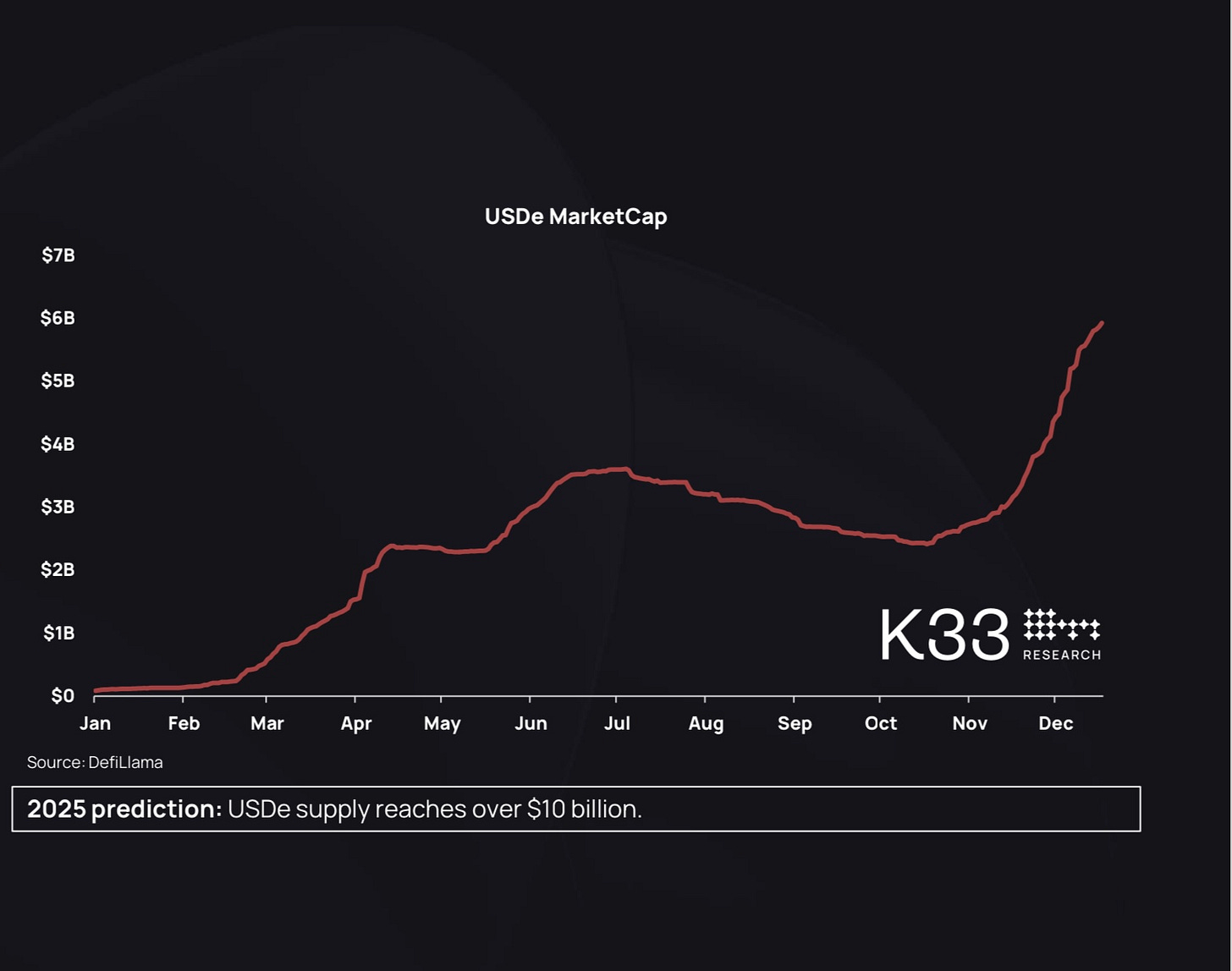

CeDeFi: A Hybrid Model Gaining Traction

Projects like Ethena are pioneering CeDeFi by blending centralized infrastructure with decentralized protocols. Ethena’s USDe stablecoin demonstrates the potential of CeDeFi in enhancing scalability and compliance.

Source: K33 Research

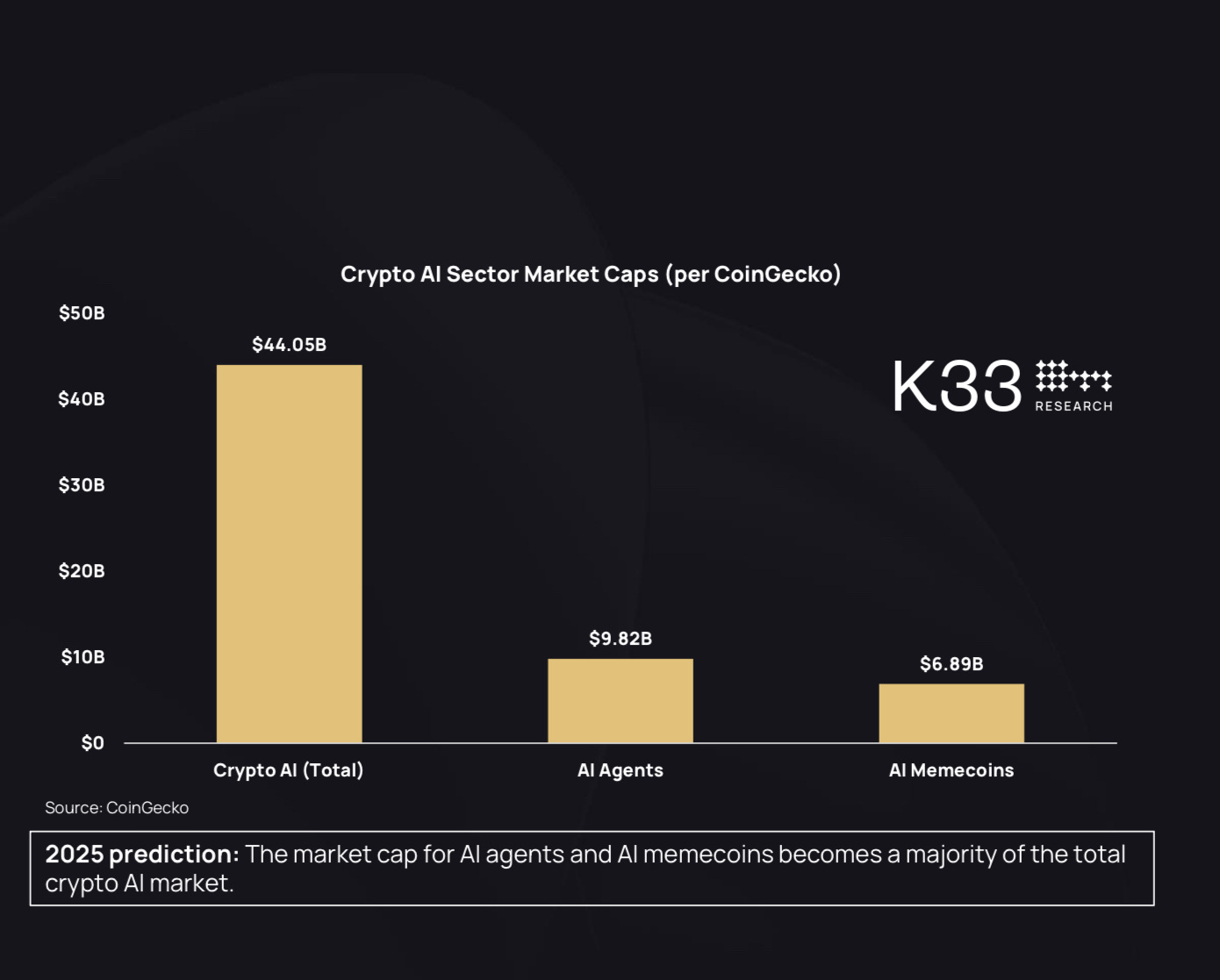

Crypto AI: The Next Disruptor in Blockchain

Source: K33 Research

The intersection of blockchain and artificial intelligence has introduced AI agents, autonomous entities capable of executing smart contract functions without human intervention. This emerging sector is poised to transform areas like DeFi trading and data analysis.

Example: AI-powered bots executing flash loans and arbitrage opportunities in decentralized exchanges.

Leveraging AI in Blockchain Projects: Below are the things developers Should Focus On

AI and blockchain are converging to create powerful new applications. Developers should position themselves at the forefront of this innovation by focusing on these key areas:

• Build Smarter Smart Contracts:

AI can enhance smart contracts by enabling them to adapt to changing conditions. For instance:

AI algorithms can optimize gas fees during transactions.

Smart contracts could use AI-driven predictions to adjust their terms dynamically, such as in insurance or financial agreements.

• Focus on Data Interoperability:

Blockchain networks often operate in silos. Developers should work on AI-powered solutions for cross-chain compatibility, ensuring seamless data exchange.

Example: AI-based oracles that aggregate data from multiple blockchains (e.g., Chainlink with AI modules).

• Develop User-Centric Solutions:

Many blockchain platforms are complex and not user-friendly. AI can simplify the user experience by providing:

Personalized onboarding for new users.

Platforms like dYdX already incorporate AI to improve trading interfaces.

• Explore New AI Use Cases:

Identify unexplored areas where AI can drive innovation. Examples include:

Decentralized identity verification systems powered by AI facial recognition.

AI-generated NFTs that offer unique, personalized digital assets.

By incorporating these practical steps, both investors and developers can maximize their opportunities and minimize risks in the ever-evolving crypto landscape.

Key Takeaways

1. Bitcoin’s Shorter Cycles and Future Prospects

• Bitcoin’s 2024 rally may deviate from historical cycles, with diminishing returns but increasing market cap growth, pointing toward a peak range of $146,000 to $212,500.

• Structural shifts like ETFs, institutional adoption, and nation-state interest are becoming more influential than halving events.

2. Altcoins: A Changing Narrative

• The altcoin market is evolving, with shorter performance cycles and increasing proliferation of new tokens.

• Memecoins dominated 2024, driven by platforms like Pump.fun, while tech-based altcoins like Solana and Ethereum challengers continue to make strategic moves.

3. DeFi Resurgence

• Total DeFi TVL grew by 152% in 2024, driven by falling interest rates, improved UX, and favorable regulations.

• Projects like Aave and Ethena demonstrated sustainable growth, signaling a shift from speculation to utility.

4. Crypto AI’s Emergence

• The rise of AI agents represents a convergence of crypto and AI, creating innovative use cases but still facing adoption challenges.

• The novelty of “AI memecoins” has started morphing into meaningful technology adoption.

5. Institutional and Grassroots Adoption

• Crypto adoption by institutions and governments is becoming a key market driver.

• The regulatory shift in the U.S. and the potential introduction of strategic BTC reserves could redefine market dynamics.

6. Diminishing BTC Dominance and Altcoin Season

• BTC dominance has dropped as altcoins gained traction, signaling the start of a potential altcoin season.

• However, capturing altcoin gains requires careful selection due to the overwhelming number of new tokens entering the market.

7. The Future of Blockchain Ecosystems

• Ethereum remains dominant in DeFi TVL but is losing ground in retail adoption to Ethereum-aligned L2s and challengers like Solana and Sui.

• Innovations such as Hyperliquid’s $1.2 billion airdrop highlight the competitive and rapidly evolving landscape.

Future Outlook: What Lies Ahead for Crypto in 2025 and Beyond

As Bitcoin matures, macroeconomic factors, institutional adoption, and regulatory clarity will play larger roles in shaping the market. The landscape in 2025 and beyond promises exciting opportunities and challenges. Here are some key developments to watch for:

The End of Traditional 4-Year Bitcoin Cycles

• Bitcoin’s halving events and their historical influence on price movements may become less impactful in future cycles. As Bitcoin matures, institutional involvement, regulatory frameworks, and macroeconomic factors such as inflation and interest rates will likely become the dominant drivers of market movements.

• The transition from cyclical to more sustainable growth patterns means Bitcoin could see less extreme volatility, with a more stable long-term upward trajectory. This shift could also alter the investment strategies that have historically capitalized on Bitcoin’s cyclical nature.

Institutionalization of Crypto: ETFs and Strategic Reserves

• The introduction of Bitcoin ETFs and other crypto-related financial products will likely pave the way for deeper institutional adoption. ETFs provide easier access to Bitcoin for traditional investors, and as institutional interest grows, so does the potential for Bitcoin to be seen as a hedge asset alongside gold.

• The idea of U.S. strategic Bitcoin reserves, akin to gold reserves, is gaining traction. This would signal Bitcoin’s maturity as a store of value and could significantly influence its price, with a focus on long-term holding rather than short-term speculation.

Integration of Crypto in Traditional Finance and Business

• With blockchain technology becoming increasingly integrated into business operations and financial systems, decentralized finance (DeFi) platforms will see increased adoption.

• DeFi projects like Aave and MakerDAO are evolving from speculative projects into stable financial services, which could make them part of the mainstream financial system in years to come. Traditional financial institutions may also look to integrate decentralized protocols into their operations, further bridging the gap between Web3 and Web2.

The Rise of Layer 2 Solutions and Ethereum’s Future

• Ethereum’s position as the backbone of decentralized applications (dApps) remains solid, though it faces competition from Layer 1 alternatives like Solana, Sui, and Avalanche. However, Layer 2 solutions like Arbitrum and Optimism could maintain Ethereum’s dominance by offering faster and cheaper transactions, drawing more developers and users to the network.

• As the Ethereum ecosystem continues to evolve, the rise of Ethereum 2.0 and its scalability solutions could address the network’s current limitations, making it an even more attractive platform for decentralized finance, NFTs, and other Web3 applications.

The Proliferation of Altcoins and Memecoins

• The rapid launch of new altcoins and tokens, often through platforms like Pump.fun, will continue, but the market may see consolidation as only the strongest projects with real utility stand the test of time.

• Memecoins, though often dismissed as speculative, will remain a significant part of the crypto landscape. Their role in driving community engagement, speculation, and liquidity could lead to greater recognition from both retail and institutional investors. The emergence of memecoins linked to real-world use cases or AI-based projects may further blur the lines between novelty and substance.

The Advent of Crypto AI and AI-Driven Blockchain Solutions

• Crypto AI, though still in its early stages, is expected to become one of the most disruptive trends in the coming years.

• These AI agents could play a critical role in improving scalability, security, and operational efficiency within decentralized applications.

Global Regulatory Developments and the Role of Nation-States

• Government regulation will continue to be a crucial factor in the future of crypto. The ongoing regulatory changes in the U.S., EU, and other major markets will set the tone for how cryptocurrencies can be integrated into existing financial systems.

• Nation-state adoption of cryptocurrencies as legal tender, such as El Salvador’s adoption of Bitcoin, could become more widespread, prompting other countries to explore national digital currencies (CBDCs) or allow decentralized assets to coexist alongside traditional currencies.

Stablecoins and the Future of Digital Fiat

• Stablecoins will continue to grow, with their use cases expanding beyond simple digital fiat currency alternatives to serving as integral components of decentralized finance ecosystems.

• Projects like USDC and Tether will likely face more regulatory scrutiny, but their central role in enabling decentralized lending, borrowing, and cross-border transactions will cement their place in the future of crypto.

The Evolution of DeFi and CeFi Hybrids

• The DeFi space, while already booming, will mature and evolve from a high-risk, speculative environment to one where regulations, compliance, and institutional adoption become more prominent.

• “CeDeFi,” a hybrid of centralized and decentralized finance, will likely continue to grow, offering the best of both worlds—centralized security and decentralized innovation.

Conclusion:

The future of cryptocurrency and blockchain technology holds immense potential for transforming traditional finance, creating decentralized economies, and disrupting global industries. As Bitcoin, Ethereum, altcoins, DeFi, and AI-powered projects evolve, the crypto ecosystem will continue to shape new investment opportunities, technological advancements, and regulatory frameworks.

For investors, traders, and crypto enthusiasts, staying informed and adapting to these shifts will be key to thriving in the rapidly evolving landscape. By understanding the critical drivers behind these changes, from institutional adoption and the rise of Layer 2 solutions to the proliferation of memecoins and AI integration, one can position themselves for success in the next phase of the digital revolution.