Bitcoin Bills, MetaMask Metal, and Ethereum’s 100x Gas Play: This Week’s Biggest Crypto Shifts You Can’t Ignore

From Arizona’s historic Bitcoin reserve law to Ethereum’s ambitious gas limit upgrade, this week’s crypto landscape was filled with pivotal events. Dive into the biggest moves, market shifts, and future implications shaping Web3.

Is Crypto Finally Going Mainstream?

What do a U.S. state adopting Bitcoin, Mastercard launching a stablecoin ecosystem, and Ethereum proposing a 100x gas limit increase have in common?

They’re all signs that crypto is no longer a fringe experiment, it’s going full throttle into the global financial and tech mainstream.

In this week’s recap, we unpack the most powerful narratives that moved the market and rewired the Web3 space. From bullish regulatory plays to groundbreaking product launches, this wasn’t a week to sit on the sidelines.

So grab a coffee, and let’s decode the most important events shaping the future of crypto and what they mean for you as an investor, builder, or enthusiast.

1. Arizona’s Bitcoin Bill: A Historic First for U.S. State Reserves

“Bitcoin is no longer just an asset; it’s entering the balance sheets of U.S. governance.”

Arizona made history this week by becoming the first U.S. state to pass a Bitcoin Strategic Reserve Bill through both the House and Senate. The bill allows the allocation of up to 10% of the state’s reserve funds into Bitcoin, pending final approval from the governor.

Why This Matters:

Government-level adoption gives BTC newfound legitimacy as a strategic asset.

Signals a policy shift toward decentralization and alternative reserves.

Could inspire other U.S. states or even federal-level discussions.

Real-life Parallel: El Salvador became the first country to make Bitcoin legal tender in 2021. Now, a U.S. state is stepping into the ring.

2. Ethereum Eyes 100x Gas Limit Increase: The Scalability Breakthrough

Ethereum researcher Dankrad Feist proposed EIP-9698, a roadmap to increase Ethereum’s gas limit by 100x over four years, allowing the network to handle up to 2,000 transactions per second natively.

What’s Changing?

Gradual gas limit increase:

10x every 2 years

Starting in June 2025

From today’s 36M gas to 3.6B by 2029

Prioritizes predictability and infrastructure readiness

Why This is a Game-Changer:

Narrows the scalability gap with high-TPS chains like Solana (65K TPS) and Aptos/Sui

Reduces reliance on rollups and fragmented Layer 2 ecosystems

Creates a more unified and faster Layer 1 Ethereum

Real-world case: Layer 1 congestion during NFT mints or DeFi booms has caused failed transactions and $100+ gas fees this proposal directly tackles that.

3. Mastercard’s Stablecoin Infrastructure: From Hype to Rails

Mastercard just announced a global stablecoin ecosystem handling end-to-end payments using real-time, interoperable systems.

What This Means:

Stablecoins are moving beyond DeFi into everyday global payments

Mastercard is embracing compliance-first, blockchain-native finance

Could fuel cross-border remittances and merchant adoption at scale

Actionable Insight: Watch stablecoins like USDC, PYUSD, and EURC they’re likely first in line for integration.

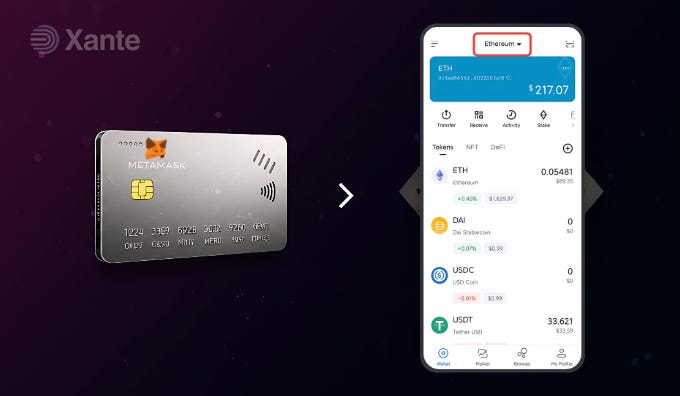

4. MetaMask Metal Card: DeFi Meets the Physical World

MetaMask, in partnership with Baanx and CompoSecure, unveiled the MetaMask Metal Card a physical card that processes transactions on-chain via smart contracts.

Key Features:

Funds are drawn from Linea, MetaMask’s zkEVM Layer 2

Transactions are transparent and self-custodied

DeFi utility, real-world spending

Use Case: Imagine using your DeFi yield earnings to buy coffee with a physical card that’s what this unlocks.

5. Coinbase BTC Yield Fund for Institutions (Launching May 1)

Coinbase announced a Bitcoin Yield Fund for institutions, offering 4%–8% APY starting May 1. It’s a step toward regulated, crypto-native fixed income products.

Why Institutions Care:

Traditional yield products are sub-5%

BTC yield products diversify treasury exposure

Compliant products = reduced regulatory friction

Real-life application: Pension funds and hedge funds now have an easy gateway to passive BTC earnings.

6. Michael Saylor Buys the Dip, Again

MicroStrategy CEO Michael Saylor doubled down, acquiring 15,355 BTC for $1.42 billion at an average price of $94,737.

Saylor now holds over 214,000 BTC, reinforcing Bitcoin’s role as a long-term treasury asset.

This move echoes MicroStrategy’s 2020 playbook, where they began accumulating BTC under $10K and sparked the corporate Bitcoin wave.

7. AI Tokens Surge Amid Institutional Interest

The AI x Crypto narrative stayed hot, with the sector’s market cap jumping 2% to $9.1B.

Top Gainers:

SERAPH: +90%

SEKOIA: +38%

LUNA: +24%

Bitthumb listing of ai16z signals rising institutional appetite for AI-linked crypto assets.

Actionable Insight: Watch for AI protocols integrating LLMs or offering data layer solutions that’s where serious alpha may lie.

NFT Market: Whale Moves and Quiet Innovation

Despite overall cool sentiment, NFT markets saw activity:

Highlights:

A rare left-facing Pudgy Penguin sold for 200 WETH (~$359K) on Gondi.

Other top movers: Seeing Signs (+59%), Duper Genesis Ace (+29%)

Takeaway: The NFT surface looks calm, but whales are still placing big bets on digital assets with scarcity and narrative.

Ledger Integrates Yield Directly via Kiln

Ledger users can now earn up to 9.9% APY on stablecoins through Kiln, without using centralized platforms.

Benefits:

Self-custody meets passive income

No need for third-party CeFi risk

Fully on-chain and transparent

Use Case: A crypto-savvy user earns USDC yield while maintaining full control of their private keys no intermediaries needed.

Tornado Cash Court Win: A Blow to Overreach

A U.S. federal court ruled against OFAC, stating it had overstepped by sanctioning Tornado Cash, a privacy protocol.

Why This is Big:

Reinforces developer rights and open-source innovation

May set a precedent for fair crypto regulation

Boosts morale in the privacy coin and zk community

Key Takeaways:

Mainstream adoption is accelerating: State-level BTC purchases and Mastercard infrastructure moves show crypto’s next frontier is institutional and real-world.

Layer 1 is evolving fast: Ethereum’s gas limit proposal signals native scalability is back on the roadmap.

DeFi meets real life: From MetaMask’s card to Ledger’s yield, on-chain finance is becoming tangible.

AI and NFTs are still heating up: Institutional eyes are on niche narratives like AI protocols and rare digital assets.

Future Outlook:

More U.S. states could follow Arizona’s lead, especially in crypto-friendly regions.

Ethereum’s EIP-9698, if adopted, could drastically reshape competition with Solana and ZK chains.

Physical crypto products (like the MetaMask card) will become more common as DeFi gets IRL-friendly.

Regulatory clarity is slowly forming expect more court rulings that define crypto’s legal boundaries.

Question to ponder: If state treasuries are buying Bitcoin, will national governments follow?

Conclusion: Crypto’s Tipping Point is Closer Than You Think

This week showed us that the crypto revolution is no longer confined to exchanges and whitepapers. It’s showing up in laws, payment rails, hardware, and institutional pipelines.

From Arizona’s bold move to Ethereum’s Layer 1 revival, this was not a normal week. It was a glimpse into the near future of finance.

Want more updates like this delivered weekly?

Subscribe to our newsletter for expert analysis to get weekly crypto insights, trend breakdowns, and smart investment takes delivered straight to your inbox and join our WhatsApp channel to continue the conversation. For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok.

This article is for educational purposes only and should not be considered financial advice. Always conduct your own research (DYOR) before making any investment decisions.