Bitcoin DeFi Is Here: The Future of BTCFi and What It Means for the Crypto Industry

Is Bitcoin finally stepping into the DeFi revolution?

For years, Bitcoin has been the undisputed king of crypto, a store of value, a hedge against inflation, and a decentralized alternative to traditional finance. But there’s always been one major limitation: Bitcoin wasn’t designed for smart contracts and DeFi applications.

Now, that’s changing.

A new movement, Bitcoin DeFi (BTCFi), is emerging. Developers are finding ways to unlock Bitcoin’s liquidity for financial applications, just as Ethereum did with DeFi in 2020. This shift could reshape Bitcoin’s role in the industry, fueling innovation and creating new revenue streams for miners, traders, and investors.

In this blog post, we will break down:

The growing potential of BTCFi

How much Bitcoin liquidity could move into DeFi

Key infrastructure challenges and solutions

The long-term impact on Bitcoin’s security, adoption, and market dominance

This article is based on insights from Binance Research, providing an in-depth analysis of the evolving Bitcoin DeFi (BTCFi) ecosystem.

Let’s get into it:

The Rise of BTCFi: How Much Capital Could Flow into Bitcoin DeFi?

Bitcoin currently has a $1.2 trillion market cap, but only a fraction of its supply is actively being used in decentralized applications. Instead, most BTC sits in cold storage or centralized custodial services, missing out on the financial opportunities that DeFi offers.

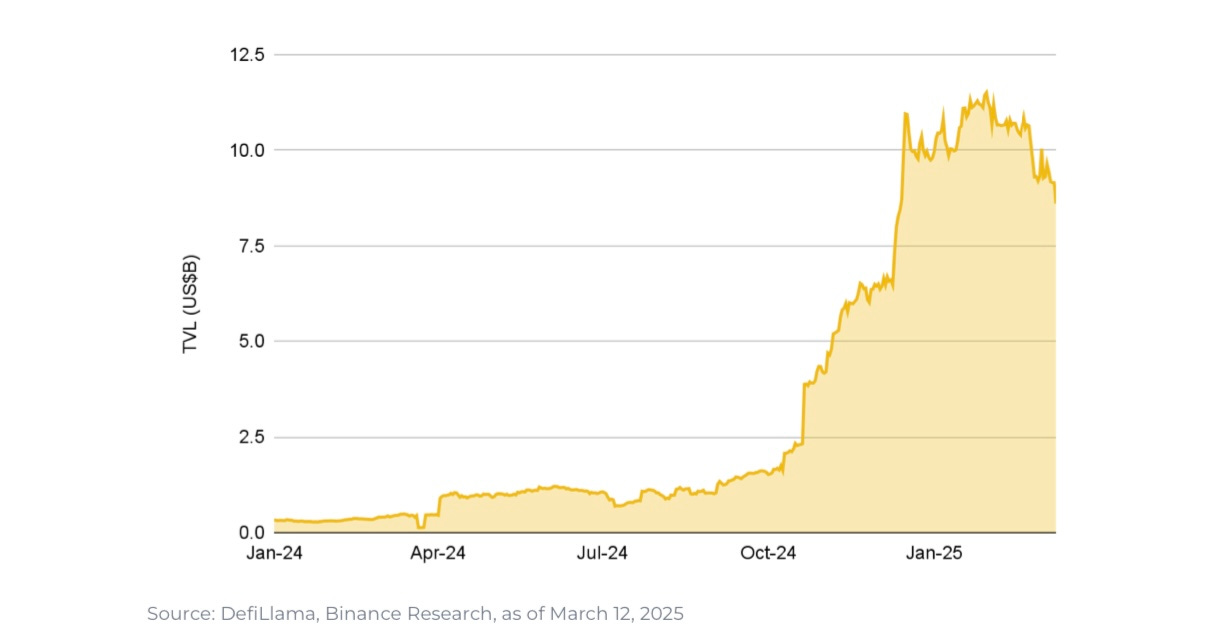

BTCFi TVL has grown 2,767% since the start of 2024, rising from US$0.3B to US$8.6B.

Bitcoin market dominance has been on a strong upward trajectory this cycle, reaching ~60% this year — its highest level in four years

Protocols like Sovryn and ALEX have been at the forefront of BTCFi adoption, enabling lending, borrowing, and trading directly on Bitcoin Layer 2s. Sovryn, built on Rootstock (RSK), allows BTC holders to earn yield and access DeFi services without relying on Ethereum. Meanwhile, ALEX on Stacks provides Bitcoin-native liquidity pools and smart contract functionality.

Unlocking Bitcoin’s Trapped Value

BTCFi is aiming to change that by creating native financial applications on Bitcoin’s own infrastructure. If BTCFi adoption mirrors the trajectory of Wrapped Bitcoin (WBTC) and other tokenized BTC products, we could see an estimated $31.9 billion worth of Bitcoin moving into DeFi.

To put that into perspective, if BTCFi reached that level today, it would place it among the top 10 largest crypto projects by market cap.

Real-World Example: In 2020, Ethereum’s DeFi boom unlocked billions in capital, leading to the rise of lending platforms like Aave and Compound. If BTCFi follows a similar path, it could create an entirely new financial ecosystem built on Bitcoin’s security and liquidity.

Why BTCFi Is More Than Just Wrapped Bitcoin

Wrapped Bitcoin (WBTC) and similar solutions have allowed BTC holders to participate in DeFi, but they come with trade-offs:

• Custodial risks: Users must trust third parties to manage their BTC.

• Security concerns: Cross-chain bridges have been exploited in major hacks.

• Regulatory uncertainties: Some governments may impose restrictions on tokenized BTC.

BTCFi-native platforms like Liquidium and DLC.Link are working to solve these problems by enabling trustless Bitcoin-backed lending and DeFi solutions without requiring tokenized BTC. Liquidium allows users to take out loans using BTC as collateral without needing a centralized intermediary, while DLC.Link leverages Discreet Log Contracts (DLCs) to create secure and trust-minimized Bitcoin smart contracts.

BTCFi solves these issues by building financial applications directly on Bitcoin’s network, rather than wrapping BTC on other blockchains like Ethereum or Solana.

Challenges and Barriers to BTCFi Growth

While BTCFi’s potential is massive, there are major hurdles that need to be addressed:

1. Smart Contract Limitations

• Unlike Ethereum’s account-based system, Bitcoin uses a UTXO model, which makes it harder to implement complex smart contracts.

• However, innovations like BitVM and Bitcoin Layer 2s (L2s) are bringing smart contract functionality to Bitcoin, making BTCFi more viable.

2. Scalability Issues

• Bitcoin’s block size and transaction times aren’t optimized for DeFi.

• L2 solutions like Stacks, RSK, and Lightning Network aim to fix this by offering faster and cheaper transactions.

3. Liquidity Gaps

• Despite Bitcoin’s high market cap, DeFi liquidity is concentrated on Ethereum and BNB Chain.

• BTCFi needs incentives, partnerships, and better user experiences to attract liquidity providers.

Why BTCFi Matters for Bitcoin’s Future

1. Strengthening Bitcoin’s Security Model

Bitcoin’s block subsidy is shrinking with each halving event. Miners must increasingly rely on transaction fees for revenue.

BTCFi can help solve this problem:

• Financial applications generate higher on-chain transaction fees.

• More fee revenue keeps miners incentivized, ensuring long-term network security.

• The recent Ordinals and BRC-20 boom showed how increased demand for Bitcoin block space can drive fee growth.

2. Expanding Bitcoin’s Use Cases

BTC has long been viewed as “digital gold”, a store of value, but not much else. BTCFi could change that by introducing:

• Bitcoin-based lending markets

• Yield-generating staking solutions

• Decentralized exchanges (DEXs) for Bitcoin trading

3. Regulatory and Institutional Adoption

Institutions are increasingly interested in Bitcoin, especially after the launch of spot BTC ETFs. BTCFi could give them even more reasons to allocate capital into Bitcoin.

However, regulation remains a challenge:

• U.S. regulatory clarity is still evolving.

• Compliance frameworks (AML/KYC) will be critical for BTCFi adoption.

Case Study: The 2024 Bitcoin ETF approvals brought billions in institutional inflows. If BTCFi platforms align with regulatory requirements, they could attract similar investment flows.

Key Takeaways: BTCFi’s Pros, Cons, and Adoption Potential

Opportunities:

• Unlocks billions in idle Bitcoin liquidity.

• Strengthens Bitcoin’s security model by increasing miner fee revenue.

• Expands Bitcoin’s real-world utility beyond being just a store of value.

Challenges:

• Bitcoin’s technical limitations make DeFi integration difficult.

• Liquidity constraints need to be addressed through incentives.

• Regulatory clarity is still evolving, which could impact institutional adoption.

Future Outlook: What’s Next for BTCFi?

The Bitcoin ecosystem is evolving rapidly, and BTCFi is set to play a major role in its next growth phase. Here’s what to watch:

More Bitcoin Layer 2 Adoption:

• Expect new BTCFi projects leveraging Stacks, RSK, and BitVM.

Growing Institutional Interest:

• Institutions may explore BTCFi lending markets and structured Bitcoin products.

Regulatory Developments:

• Governments will start addressing BTCFi compliance frameworks.

DeFi Expansion Beyond Ethereum:

• BTCFi could bring Bitcoin liquidity into the broader DeFi space, challenging Ethereum’s dominance.

DeFi transformed Ethereum. Will BTCFi do the same for Bitcoin?

Closing Thoughts: Is BTCFi the Future of Crypto Finance?

Bitcoin’s role in crypto is changing. No longer just a store of value, it’s now becoming a financial powerhouse with DeFi applications built directly on its network.

BTCFi is still in its early stages, but if it succeeds, it could unlock trillions in capital, reshape Bitcoin’s security model, and open new investment opportunities for users worldwide.

The big question: Will Bitcoin holders embrace BTCFi, or will they resist financialization?

Let us know your thoughts in the comments below!

For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok. Subscribe to our newsletter for expert analysis and join our WhatsApp channel to continue the conversation.

This article is for educational purposes only and should not be considered financial advice. Always conduct your own research (DYOR) before making any investment decisions.