Crypto Chaos or New Normal? Inside the Rise of Internet Capital Markets, $700M BTC Buys, Meme Madness, and NFTs’ Comeback

Crypto went full throttle this week: $700M BTC buys, a sitting U.S. VP heading to Bitcoin Vegas, memecoins exploding, NFTs bouncing back, and a bold new model “Internet Capital Markets” taking off via BELIEVE and LAUNCHCOIN. Let’s break it all down.

Is Crypto Entering Its Most Unpredictable Era Yet?

Are we witnessing just another week of crypto volatility, or are we entering a new phase where memes, markets, and belief systems collide to create a new financial infrastructure?

Welcome to this week’s crypto recap, where we’re unpacking a series of extraordinary events, from institutional Bitcoin buys and a political first to the viral rise of @believeapp and a reimagined way to fund ideas via the Internet Capital Market.

Whether you’re a Web3 founder, investor, or just a curious degen, this article will give you the insight you need to make sense of it all with clear breakdowns, real-world examples, and actionable ideas for what’s next.

Table of Contents

Big Players Are Buying Big. Again.

BlackRock’s Quiet Meetings Signal Something Big

Bitcoin in Politics: A Historic Milestone

Memecoins: The Unexpected Lifeline of 2025

NFTs: Not Dead Yet

BELIEVE & LAUNCHCOIN: Bootstrapping the Belief Economy

AI x Crypto: The Sleeping Giant Awakens

Market Snapshot

Key Takeaways

Future Outlook

Conclusion.

Big Players Are Buying Big. Again.

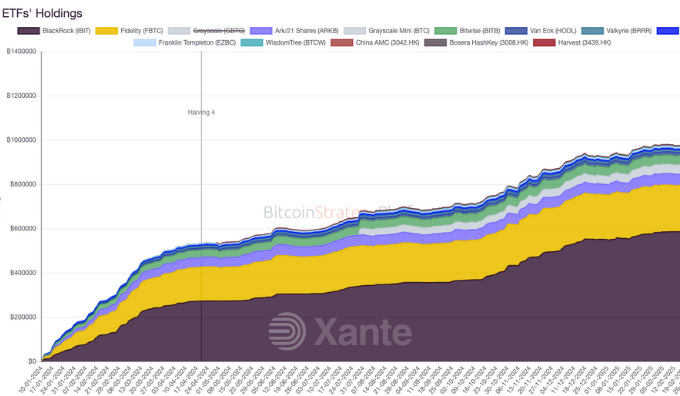

Institutional interest in Bitcoin is back and stronger than ever.

David Bailey launched Nakamoto, a firm set to acquire $700M in Bitcoin. The move was paired with a merger into Kindly MD, which saw a 450% pre-market surge in its stock.

Metaplanet, often dubbed Japan’s MicroStrategy, bought 1,241 BTC, bringing its holdings to nearly $700M.

Beat Holdings raised $34M to join the Bitcoin race.

Real-world example:

Metaplanet’s bold accumulation mirrors MicroStrategy’s 2021 strategy, where relentless BTC buys helped reshape its public image and stock value signaling how belief in BTC is now a corporate asset class strategy.

BlackRock’s Quiet Meetings Signal Something Big

On May 9, BlackRock met with the SEC’s Crypto Task Force to discuss:

ETF approval frameworks

Staking regulations

Tokenized assets

Crypto ETF expansions

This is more than a compliance chat. It’s a slow pivot from TradFi giants into full blockchain integration.

What this means:

BlackRock isn’t just “interested” anymore. They’re laying groundwork to dominate a multi-chain, tokenized financial future.

Quote Block:

“The next frontier in finance isn’t just digital, it’s decentralized.”

Larry Fink, CEO of BlackRock (2024 Annual Letter)

Bitcoin in Politics: A Historic Milestone

For the first time in history, a sitting U.S. Vice President (JD Vance) is speaking at Bitcoin 2025 Vegas.

This isn’t just PR, it’s political validation. Crypto is now part of mainstream policy conversations.

Why this matters:

If crypto becomes a campaign topic in the 2026 midterms, expect regulatory clarity to evolve, fast.

Memecoins: The Unexpected Lifeline of 2025

You thought the memecoin wave had peaked? Think again.

Weekend Stats:

DOGE: +40%

SHIBA, BONK, PEPE: +60–100%

Total Memecoin Market Cap: +65% to $77B

Top Movers:

MOODENG: +600%

GOAT: +200%

FWOG: +160%

PNUT: +155%

Newcomer USELESS (Solana): +95%

Actionable Insight:

Use meme charts as social sentiment indicators. If “joke” coins are rallying, it often precedes or follows broader altcoin runs.

NFTs: Not Dead Yet:

NFT trading volume on Bitcoin surged, marking its best weekend in months.

Top BTC Projects:

Bitcoin Puppets: +50%

Taproot Wizards: +10%

NodeMonkes: +17%

Quantum Cats: +15%

ETH-based Trends:

CryptoPunks: +2% (now 45.5 ETH)

Pudgy Penguins: +3%

BAYC: -3%

Doodles: -10%

Real-world Event:

Frank DeGods stepping down from his project sparked a 26% rally in DeGods, proving leadership changes still heavily influence NFT markets.

BELIEVE & LAUNCHCOIN: Bootstrapping the Belief Economy

One of the most interesting experiments this week came from @believeapp and @launchcoin, reinventing how ideas get funded.

How It Works:

Tweet your idea with a $TICKER and tag @launchcoin.

If your token reaches $100K market cap, it “graduates” to the open market (via Meteora).

You earn 50% of fees generated, use it to build your product.

Why It’s Interesting:

No VCs, no pitch decks.

Just market belief = instant funding.

You test demand before writing a single line of code.

Real-World Use Case:

A creator tweeted about a tokenized marketplace for digital pets. The token hit $120K in under 48 hours, and now they’re actively building with claimed fees.

Concerns:

Can creators actually deliver post-pump?

Is it sustainable without long-term value?

What happens when hype fades?

AI x Crypto: The Sleeping Giant Awakens

AI tokens saw healthy gains again this week:

FARTCOIN: +4%

ai16z: +13%

GOAT: +35%

PIPPIN: +95%

Trending Narratives:

AI + DeFi integrations

Virtual assistants for on-chain tasks

Tokenized compute marketplaces

Mindshare winners:

Virtual, FARTCOIN, and REKT are topping mentions across social platforms.

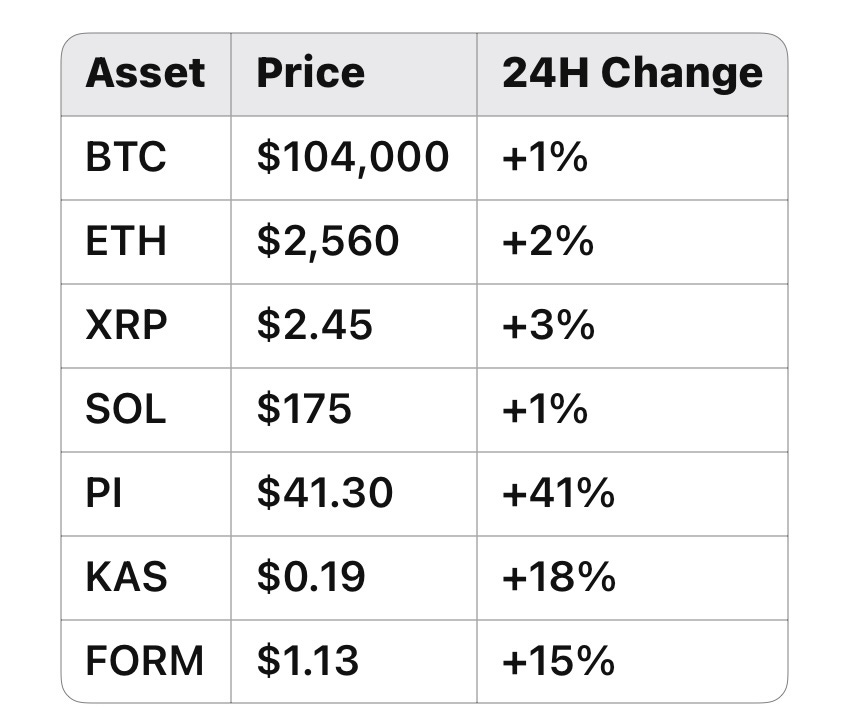

Market Snapshot

Key Takeaways

Institutional Confidence: BlackRock, Metaplanet, and others are betting big on BTC.

Memecoin Mania: Traders are using humor to navigate uncertainty and winning.

NFTs Aren’t Dead: BTC-based collections are sparking renewed interest.

New Funding Models: BELIEVE turns social signals into startup capital.

AI x Crypto Is Heating Up: Smart money is watching AI-fueled protocols.

Future Outlook

Regulatory Waves: Expect major developments post-election, especially if VP Vance brings crypto into U.S. policy discussions.

Internet Capital Markets may become a standard path for bootstrapping early-stage ideas.

NFT Revival will hinge on integrating utility, gaming, access, DeFi.

AI x Web3: Expect deeper mergers, AI agents managing wallets, smart contract automation, and token-gated data markets.

Conclusion

This week wasn’t just busy, it was foundational.

From high-stakes BTC buys and meme madness to a reinvented internet funding model, the crypto space is evolving faster than ever.

Now the big question is: Are you paying attention, or will you watch from the sidelines?

Subscribe to our newsletter for expert analysis and join our WhatsApp channel to continue the conversation. For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok.

This article is for educational purposes only and should not be considered financial advice. Always conduct your own research (DYOR) before making any investment decisions.

What part of this week surprised you most? Drop your answer in the comment below.