Crypto in 2025: Bold Predictions and Trends Shaping the Future

The Crypto Golden Era

This blog post delves into the transformative predictions for the crypto industry in 2025, the core source of this data is Bitwise Investment. In this post, we will explore:

Bitcoin’s Surge: Why experts believe Bitcoin could surpass $200,000, with the potential for higher milestones.

The Role of Institutions: How Bitcoin ETFs, 401(k) plans, and tokenized assets are driving institutional adoption.

AI’s Role in Crypto: The rise of AI-launched tokens and their impact on innovation.

Stablecoin Growth: Legislative backing and real-world use cases powering a $400 billion market.

Challenges and Risks: Regulatory, scalability, and speculative risks to watch for in the evolving landscape.

Why 2025 Could Be the Golden Age of Crypto

The cryptocurrency industry is on the brink of transformative change. With Bitcoin achieving record-breaking highs in 2024 and growing adoption among institutions and governments, 2025 promises to be a defining year for crypto. Let’s get into what the future holds for crypto.

Crypto Market Trends for 2025

Bitcoin’s Meteoric Rise

Bitcoin is poised to surpass $200,000 by 2025, driven by institutional demand, supply constraints from the April 2024 halving, and geopolitical factors. Example: In 2024, Bitcoin’s price skyrocketed to $103,992 due to the U.S. launch of spot Bitcoin ETFs, which attracted over $33.56 billion in inflows.

Ethereum’s Resurgence Through Layer-2 Solutions

Ethereum’s growth is fueled by Layer-2 networks like Base and Starknet, which reduce congestion and transaction costs.

Example: The adoption of Layer-2 scaling solutions enabled faster, cheaper transactions, bringing Ethereum back into the spotlight after competition from newer blockchains.

Solana’s Evolution Beyond Memecoins

Once famous for hosting memecoin projects, Solana is now attracting serious developers and projects due to its high-speed transactions and scalability. Example: Solana’s network was pivotal in supporting AI-driven projects, which elevated its reputation among blockchain developers in 2024.

The Role of Institutions in Crypto Adoption

Bitcoin ETFs: A Catalyst for Institutional Inflows

Bitcoin ETFs are expected to outperform 2024 inflows, as major financial firms integrate crypto products into their offerings.

Example: Gold ETFs saw exponential inflow growth after launch, suggesting Bitcoin ETFs could follow a similar trajectory.

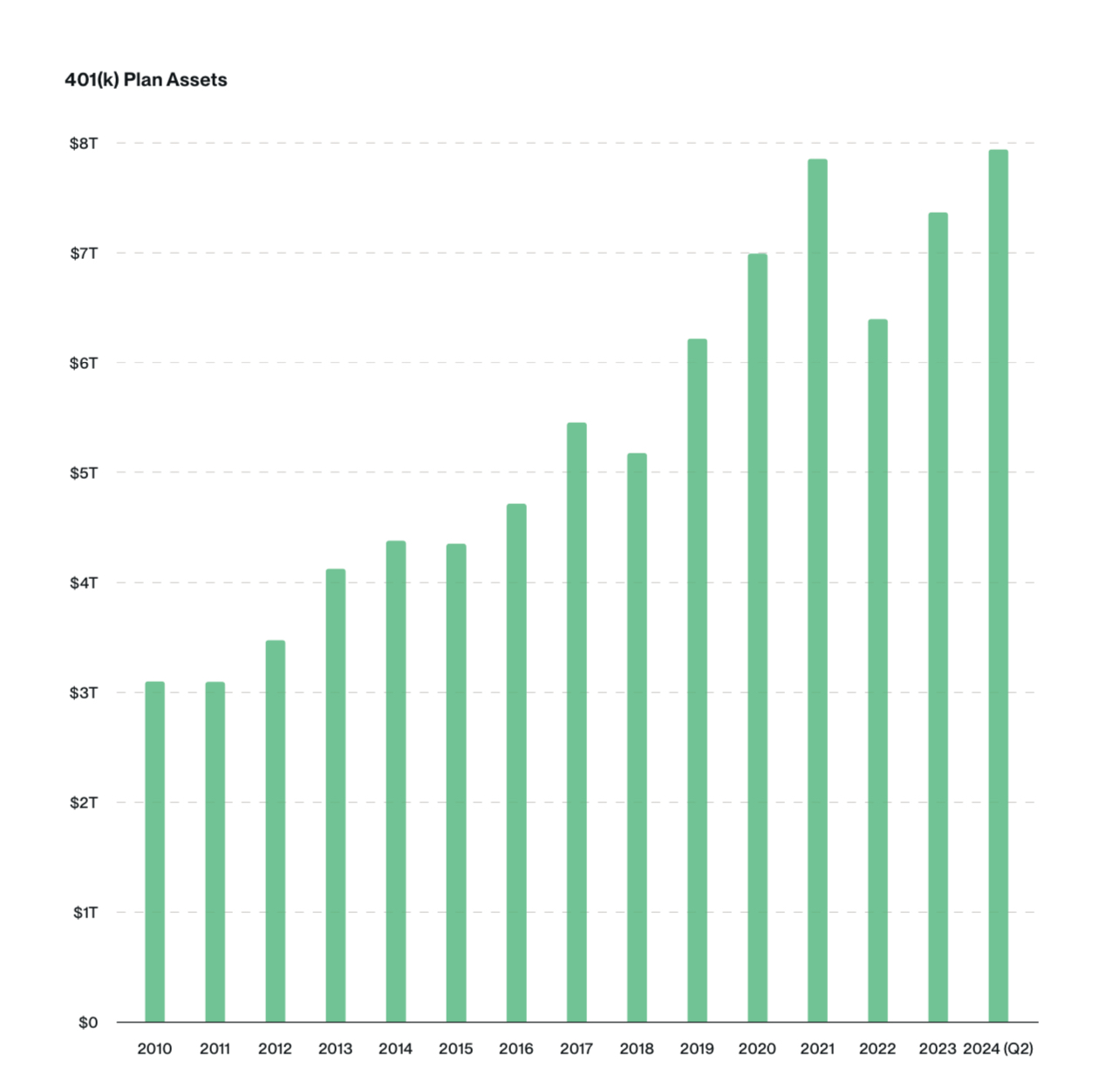

Crypto in 401(k) Plans

The U.S. Department of Labor is likely to ease restrictions on crypto investments in retirement plans, unlocking trillions in capital.

401(k) plans in the U.S. hold $8 trillion in assets. Every week, more capital funnels into these funds. If crypto captures 1% of 401(k) assets, that's $80 billion of new capital entering the space, with a steady flow thereafter. A 3% capture would be $240 billion.

Source: Bitwise Asset Management with data from The Investment Company institute and Department of Labor. Data as of September 19,2024.

Example: Fidelity’s pilot program already allows users to allocate a portion of their 401(k) to Bitcoin, signaling broader acceptance.

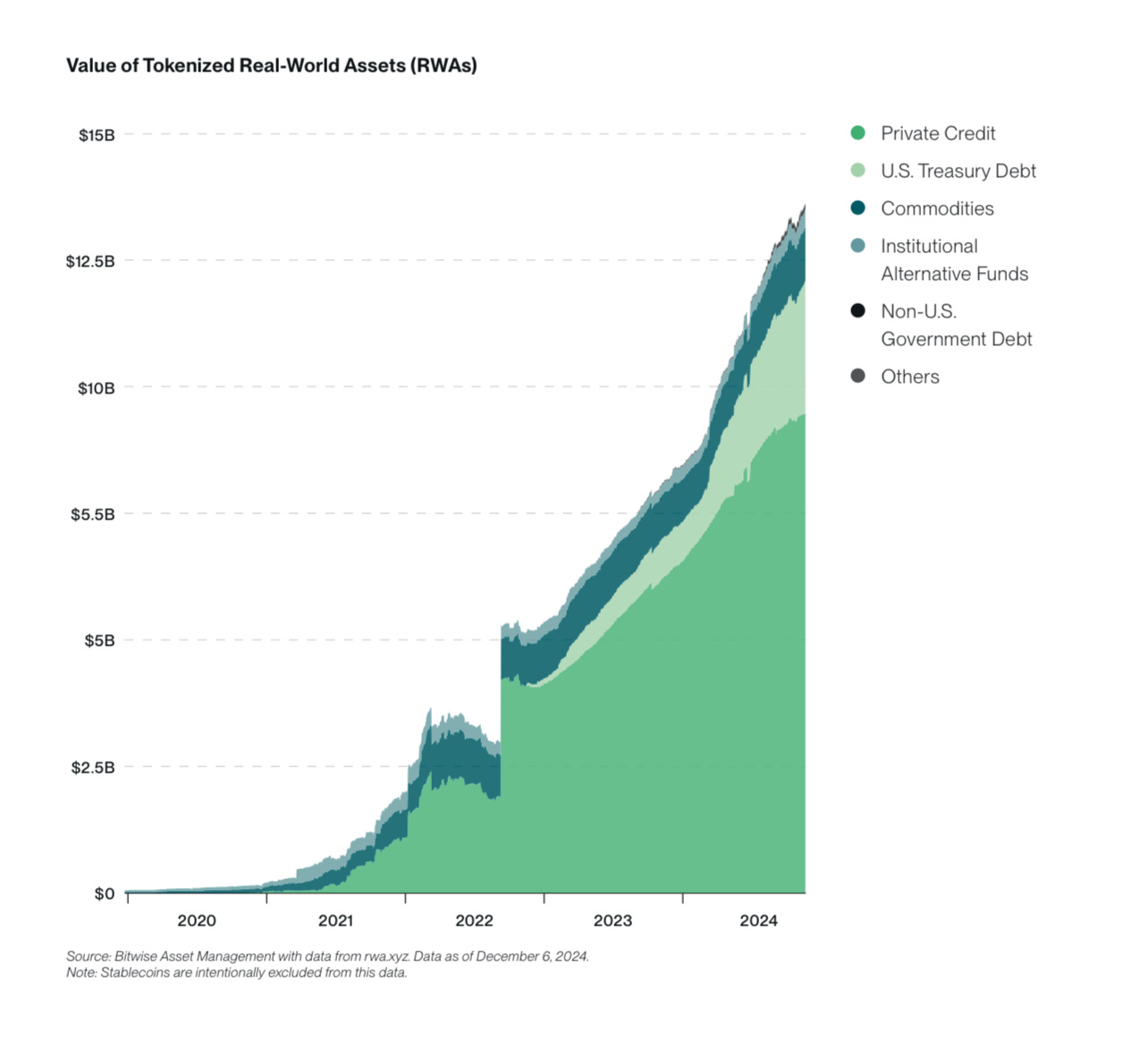

Tokenized Real-World Assets (RWAs)

Three years ago, the crypto industry had "tokenized" less than $2 billion or real-world assets, or RWAs (think private credit, U.S. debt, commodities, and stocks). Today, that market sits at $13.7 billion.

Tokenized assets like U.S. Treasury debt and private credit could exceed $50 billion in value by 2025, enabling new forms of investment.

Example: JP Morgan’s Onyx platform demonstrates how financial institutions are embracing tokenized assets for efficiency and accessibility.

The Rise of AI-Driven Memecoins

AI is reshaping the memecoin landscape, creating tokens with dynamic functionality and utility.

Example: Clanker, an AI-launched token, gained popularity in 2024, demonstrating how artificial intelligence can drive crypto innovation.

Clanker is an AI agent that is designed to deploy tokens autonomously on coin base layer 2 scaling solutions, Base. Users simply tag Clanker in a post on Farcaster telling the AI agent to launch a token with a given name and image, and it automatically deploys the token.

Key Industry Players in the Spotlight

Coinbase’s Predicted Dominance

Coinbase’s valuation is expected to exceed $700 per share, outpacing traditional financial giants like Charles Schwab.

Growth Drivers:

•Staking and custody services are projected to generate $1 billion annually.

•Base (Layer 2) adoption among developers and users.

The Crypto IPO Boom

At least five crypto unicorns, including Circle and Kraken, are anticipated to go public in 2025.

Example: The success of Coinbase’s IPO in 2021 sets the stage for similar ventures.

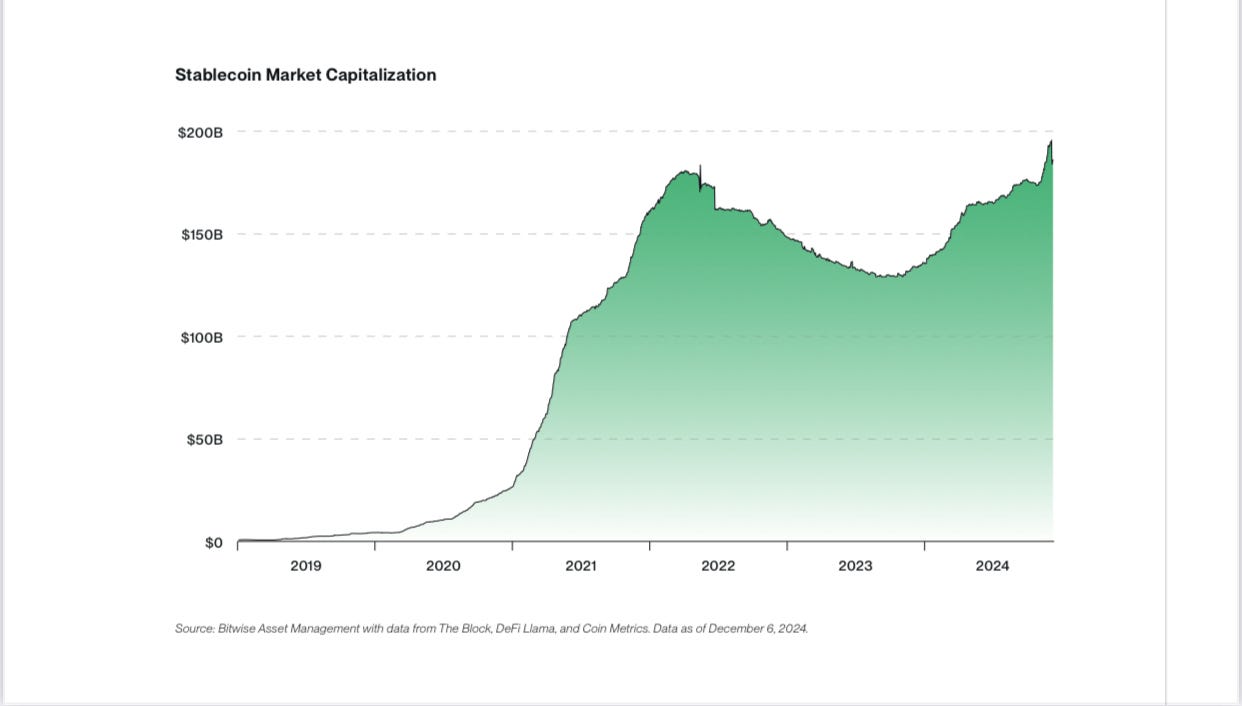

Stablecoins: The Growth Story of 2025

Stablecoins are already eating into the global payments and remittances market. The $8.3 trillion we’ve seen in stablecoin transactions in 2024 is just shy of Visa’s $9.9 trillion in payment volume over the same period. On top of that, stablecoin giant Tether recently financed a $45 million crude oil transaction via its USDT stablecoin, a clear sign of stablecoins’ potential to facilitate large-scale global trade. Demand for stablecoins will grow as digital dollars continue to disrupt these massive markets.

Stablecoin assets are expected to double to $400 billion, driven by new legislation and increased adoption in global trade.

Example: USDC’s partnership with Visa for cross-border payments highlights the growing use of stablecoins in real-world applications.

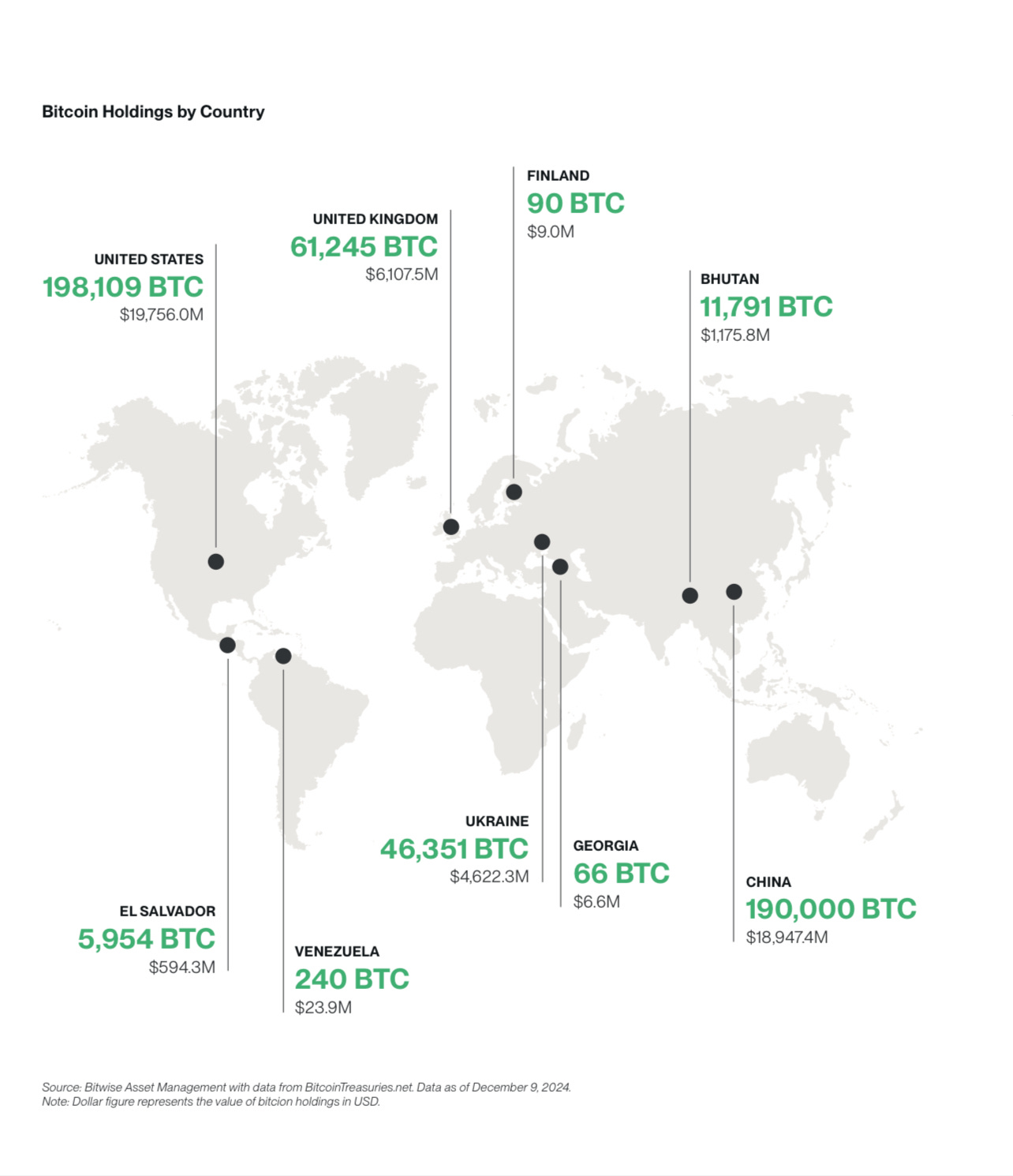

The Global Stage: Nation-State Adoption of Crypto

Countries holding Bitcoin are likely to double by 2025, spurred by geopolitical competition and advocacy for Bitcoin as a strategic reserve. The fact that the U.S. is actively considering building a strategic bitcoin reserve will kick off an arms race around the world for governments to buy bitcoin before it's too late. You're already seeing it, with legislators from Poland to Brazil introducing bills pushing for strategic bitcoin reserves in their countries.

According to BitcoinTreasuries.net, there are currently nine countries with bitcoin holdings (led by the United States). We expect this to double in 2025.

Example: El Salvador’s adoption of Bitcoin as legal tender has inspired other nations to explore crypto-backed reserves.

In 2029, Bitcoin Will overtake the $18 trillion gold market and trade above $1 million per bitcoin.

Why 2029? Bitcoin has historically moved in four-year cycles. While there's no guarantee that will persist, 2029 would mark the end of the next cycle (as well as the 20th anniversary of bitcoin's creation).

Topping gold within 20 years of launching would be quite an achievement, but we think bitcoin can do it.

(Note: If the U.S. announces it is buying 1 million bitcoins for a strategic bitcoin reserve, we could get to $1 million per bitcoin a lot faster)

Challenges to Watch Out For

Regulatory Uncertainty

While progress has been made, unclear regulations remain a risk for crypto adoption.

Example: The SEC’s scrutiny of crypto platforms has caused setbacks for several projects.

Scalability and Environmental Concerns

High energy consumption and scalability issues continue to be challenges for major blockchains.

Example: Ethereum’s transition to Proof of Stake significantly reduced energy usage, setting a precedent for sustainability.

Speculative Frenzies and Market Volatility

The rise of AI-driven tokens and memecoins could lead to speculative bubbles, posing risks to market stability.

Key Takeaways and Future Outlook

1. Benefits: Crypto is becoming more accessible, with growing institutional and governmental adoption.

2. Risks: Regulatory challenges and market volatility remain concerns.

3. Future Predictions: Bitcoin could surpass $1 million by 2029, with tokenized assets reshaping global finance.

Summary

The future of cryptocurrency by 2025 paints a dynamic picture: Bitcoin and Ethereum are likely to scale new all-time highs, fueled by institutional adoption and groundbreaking technological advancements. Stablecoins and CBDCs will coexist, enhancing global financial inclusivity. Simultaneously, DeFi and tokenization will redefine traditional finance, while eco-friendly blockchain solutions address sustainability concerns. The increasing overlap between artificial intelligence and blockchain promises unprecedented innovations, creating a landscape of opportunities that bridge the worlds of finance, technology, and regulation.

These projections underscore the growing maturity and mainstream acceptance of the crypto industry as it continues to shape the global economy.

As we approach 2025, the crypto industry is evolving rapidly, with new opportunities and challenges. Whether you’re an investor, developer, or enthusiast, understanding these trends will help you navigate the decentralized revolution.

Ready to explore the future of crypto? Do not miss out on the Crypto Golden Age. Join our community that is shaping the future of finance. Explore Xante to stay connected to the market your all-in-one tool for everything Crypto.

Stay Updated!

Subscribe to our newsletter for the latest updates on Cryptocurrency news updates and the evolving world of decentralized finance. Let’s build the future together.