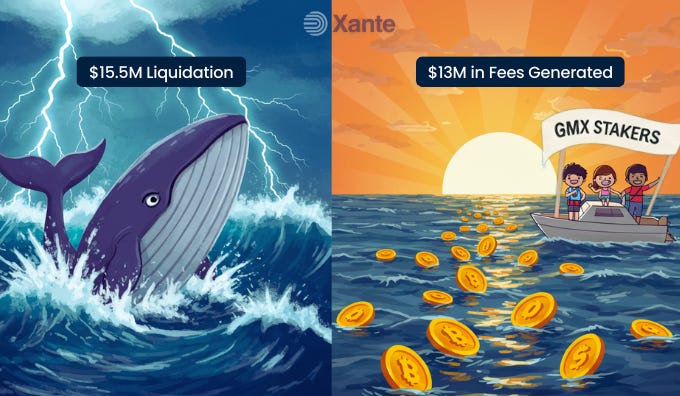

Crypto Weekly Recap: $15.5M Liquidation Shock, Airdrop Deadlines, and Market-Shaking Events You Can't Miss

This week in crypto: A whale’s $15.5M liquidation fuels GMX rewards, major airdrop deadlines approach, and protocol upgrades promise to move markets. Stay ahead with this complete news breakdown in case you missed it.

Crypto Earthquake: $15.5M Liquidation, Airdrop Alerts & Protocol Upgrades Set to Shake the Market

Did you feel that? The ground is shifting in the world of crypto and it’s not just Bitcoin’s price swings.

This week delivered a storm of major market movements, protocol-level updates, and golden airdrop opportunities that could redefine your portfolio or at least stack you up with some serious rewards.

From a whale losing $15.5M on GMX (and stakers laughing their way to the rewards pool), to time-sensitive airdrops and market-moving upgrades from giants like Aave and Eigenlayer, the past 7 days were nothing short of dramatic.

This article is your ultimate weekly recap of all things crypto:

• Actionable insights

• Real-world examples

• What to do next if you’re a trader, builder, or investor.

So, let’s get into the chaos and opportunity of this week in Web3.

1. Whale Liquidation on GMX: A Loss That Became a Win for DeFi

Imagine holding a $15.5M long position on Bitcoin… and losing it all in one swoop.

That’s exactly what happened this week on GMX, a decentralized perpetual trading platform on Avalanche and Arbitrum.

A whale had been riding a massive BTC for over a year until market volatility tipped the scales.

The Aftermath? A Win for the Community.

• The liquidation generated $13M in protocol fees for GMX.

• 30% of that ($4M) will be used for TWAP-based buybacks of $GMX.

• This puts steady upward pressure on the token, a move already creating buzz.

“This isn’t just a liquidation story. It’s a live case study of how DeFi redistributes wealth back to its users.”

Why It Matters:

• GMX has a market cap of only ~$110M so a $4M buyback is significant.

• Starting Wednesday, these fees will begin flowing to GMX stakers.

Actionable Tip:

If you’re staking $GMX on Avalanche or Arbitrum, you’re in line for rewards. If not, it might be time to consider it especially before TWAP buybacks drive further price pressure.

2. Airdrop Season: Deadlines, Claims & New Projects You Shouldn’t Sleep On

We’re officially deep into airdrop season, and missing a deadline could cost you free money.

From final claim windows to active quests and surprise KYC requirements, here’s everything you need to act on ASAP.

Urgent Airdrop Deadlines

Project: Xterio Games

Deadline: April 7

Action Required: Final claim for GameFi participants

Project: 0xIntuition

Deadline: April 9

Action Required: Complete Galxe quests

Project: Double Zero

Deadline: April 10

Action Required: Validator form submission

Project: Tea Protocol

Deadline: April 11-20

Action Required: TGE phase & KYC completion

Project: Hyperlane

Deadline: April 14

Action Required: Airdrop registration for builders

Project: Shardeum

Deadline: April 14

Action Required: Public token sale (Tokensoft)

These airdrops target active ecosystem users stakers, validators, NFT holders, and testers.

Ongoing Airdrop Updates You Should Know

• Ethena: No S3 claim tool yet. Expected this April. Stay ready.

• Babylon: Airdrop to finality providers/stakers before Dec 17, 2024. 4% of total supply allocated.

• SOON Protocol: NFT holders must complete KYC. Process is live now.

• Recall: Week 2 of quests ongoing. More quests = more rewards.

• Mezo: Farming quests active on the L3 testnet via mUSD.

• Eclipse: New updates dropped in recent AMA.

• Kernal: Launching quests with Binance Megadrop. 14% of token supply allocated to users.

Actionable Tip:

Use Earnifi or Airdrop.io to track eligibility.

Set calendar reminders for KYC, quest completions, and snapshot deadlines.

3. Protocol Upgrades & Market Events That Could Move Prices This Week

With macro pressure from U.S. tariffs to major token unlocks and network upgrades, the markets are poised for volatility.

Here are 6 major catalysts you should have on your radar:

1. $AAVE Buybacks Begin – April 9

Aave is initiating protocol buybacks, a move that recycles revenue back into the ecosystem.

This signals DAO confidence and may reduce circulating supply.

Real-World Case:

In 2021, Synthetix ($SNX) saw a similar buyback phase, leading to a short-term +80% pump.

2. Trump’s Tariff Announcement – April 9

New tariffs targeting unbalanced trade partners could stir up macro volatility. Bitcoin often performs well as a hedge in uncertain environments.

Real-World Example:

During the 2019 U.S.-China trade war, BTC saw a ~200% increase within 6 months as traditional markets flinched.

3. $EIGEN Slashing Upgrade – April 17

Eigenlayer will enable slashing for restaked assets boosting security and protocol trust.

Real-World Utility:

This is a huge step for modular Ethereum stacks relying on shared security layers.

4. $APT Token Unlock – April 12

Aptos will release $53M worth of tokens. Expect potential short-term sell pressure.

Pro Tip:

Volatility around unlocks often offers solid buyback zones for long-term believers.

5. $SEI Giga Upgrade – TBA

Sei promises a 50x boost in throughput making it a hot contender for DeFi gaming apps.

Use Case:

If you’re building or investing in GameFi, Sei’s upgrade could be a game-changer.

6. $NTRN Mercury Upgrade – April 9

Neutron becomes a sovereign PoS chain and enables staking. This will likely attract new validators and builders into its Cosmos-based ecosystem.

Actionable Tip:

Check staking dashboards to be among early adopters for delegation rewards.

Key Takeaways

• One whale’s loss on GMX generated multi-million dollar gains for stakers, a win for decentralization.

• Airdrop deadlines are real and urgent, simple actions like KYC or quest completions could net you serious tokens.

• Major protocol upgrades & macro events could spark new momentum or sell-offs positioning matters.

Future Outlook

• DeFi is maturing into a reward-rich ecosystem where user participation is finally being rewarded meaningfully.

• Airdrops are evolving, becoming more complex, requiring activity, KYC, and deeper involvement.

• Protocol economics (like buybacks and fee redistribution) are becoming central to community alignment and token value.

Expect a surge in:

• Active wallet tracking tools

• Staking-as-a-service platforms

• Real-yield protocols like GMX that turn volatility into community rewards

Projections:

According to Messari, over $4B in token airdrops could be distributed in 2025 alone and participation is the new alpha.

Conclusion: Stay Ahead, or Stay Behind

Crypto doesn’t wait.

Whales lose millions.

Protocols evolve overnight.

Rewards shift hands based on how active and informed you are.

This week showed us once again that Web3 favors the engaged whether you’re staking, testing, farming, or just paying attention.

So here’s your move.

For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok. Subscribe to our newsletter for expert analysis to get weekly crypto insights, trend breakdowns, and smart investment takes delivered straight to your inbox and join our WhatsApp channel to continue the conversation.

This article is for educational purposes only and should not be considered financial advice. Always conduct your own research (DYOR) before making any investment decisions.