Crypto Weekly Recap: Bitcoin Hits $84K, Stablecoin Wars, and a $117M Token Unlock

Is This the Start of a Crypto Supercycle? Here’s What You Need to Know

The crypto market is heating up as Q2 kicks off, with Bitcoin soaring past $84,000, Ethereum and major altcoins rallying, and institutional players making bold moves.

But beyond the price action, this week is packed with game-changing developments, from Trump’s trade war and its crypto impact to Circle’s IPO, massive token unlocks, and NFT market shakeups.

How will these events shape the market? Will Bitcoin maintain its dominance, or are we about to see major turbulence?

Let’s get into the biggest stories that could impact your portfolio this week.

Market Rebound: Bitcoin at $84K, Altcoins Surge

The market started Q2 in the green, with Bitcoin leading the charge:

• Bitcoin (BTC) is up +2%, trading at $84,000

• Ethereum (ETH) jumped +4%, reaching $1,870

• Solana (SOL) rose +3%, now at $127

• Memecoins like DOGE, SHIB, PEPE, and BONK are up 5-10% as retail hype returns

Standout Performers:

• Curve DAO ($CRV) surged +18%

• EOS ($EOS) and BERA ($BERA) gained +11%

What This Means:

• The altcoin market is waking up, potentially signaling a new bullish trend.

• Memecoins and speculative assets are gaining traction again, a sign that risk appetite is increasing.

• Is this the start of a full-fledged alt season? Keep an eye on volume and on-chain activity.

US Debt Crisis, Stablecoins, and Bitcoin’s Policy Shakeup

BlackRock CEO Larry Fink warned that if the U.S. doesn’t control its debt, the dollar could lose dominance to Bitcoin. This is huge, BlackRock has over $10 trillion in assets and is actively pushing for Bitcoin ETFs.

Meanwhile, Coinbase CEO Brian Armstrong is advocating for interest-bearing stablecoins to compete with banks, and Senator Tuberville’s Financial Freedom Act could allow Americans to invest their retirement funds into crypto.

But the real bombshell?

The U.S. Treasury is set to disclose its Bitcoin holdings on April 5 after an audit. If the U.S. government holds significant BTC reserves, it could legitimize Bitcoin as a mainstream financial asset.

Could we see a Bitcoin rally if the numbers impress?

Circle’s IPO, TradFi Meets Crypto, and New Financial Products

Circle, the issuer of USDC, is moving closer to a late April IPO with backing from JPMorgan & Citi. This could:

Further mainstream USDC adoption

Attract institutional investors into crypto

Set a precedent for crypto companies going public

Meanwhile, the Bitcoin Policy Institute introduced BitBonds, a new Bitcoin-backed financial product that ties 10% of proceeds to BTC investments.

Why This Matters:

• This signals a stronger connection between crypto and traditional finance (TradFi).

• If institutions start offering BTC-based financial products, we could see billions in capital inflows.

Trump’s Trade War: Will It Push More Investors to Bitcoin?

Former President Donald Trump is expected to announce new tariffs on April 2, reigniting global trade tensions.

Why Crypto Investors Should Care:

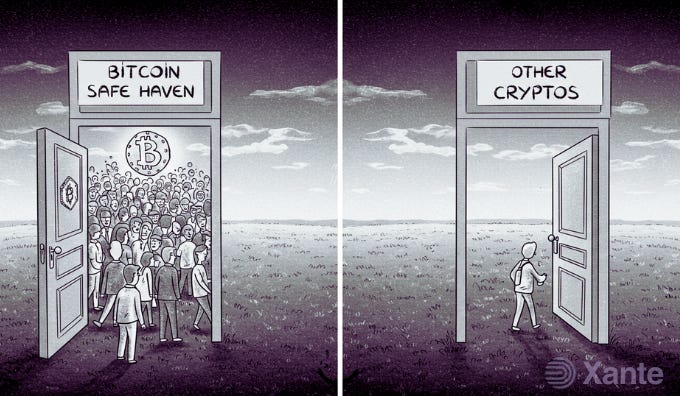

• Historically, trade wars have fueled BTC adoption as investors seek hedges against economic uncertainty.

• In 2018, during Trump’s previous tariffs, Bitcoin surged from $3,000 to $14,000 in under a year.

Will history repeat itself? If market uncertainty spikes, Bitcoin could see increased demand as a safe-haven asset.

Layer 2 & DeFi: Sonic, Mantle, and Jupiter’s Big Moves

Sonic’s USDC Integration & Network Upgrade

• Sonic is launching native USDC support and a major upgrade, making DeFi transactions cheaper and faster.

Mantle’s Q2 Roadmap: Institutional DeFi Incoming?

• Mantle is rolling out an index fund & banking expansion, signaling institutional-grade investment products.

Jupiter Exchange’s Mobile v2 Launch

• Jupiter is launching a revamped trading experience, making DeFi more accessible on mobile.

What This Means for Investors:

• Sonic and Mantle could see higher adoption as DeFi expands.

• Jupiter’s mobile upgrade could drive more on-the-go trading, boosting DEX adoption.

$117M Token Unlock “Wormhole” Incoming, Will Holders Dump?

One of the biggest events this week is a massive $117M token unlock on April 3 is Wormhole (W) (~47% of the total supply).

What’s the risk?

• Token unlocks often lead to sell pressure as early investors take profits.

• If whales dump their holdings, it could trigger a short-term price drop.

How to Prepare:

• Watch for pre-unlock front-running, traders may sell before the unlock and buy the dip.

• Check whale wallet activity to see if big holders are selling or holding.

NFTs & Memecoins: A Tale of Two Markets

Ethereum NFTs are mostly green:

• CryptoPunks: 42.5 ETH (flat)

• Pudgy Penguins: +2% at 10.1 ETH

• BAYC: +5% at 15 ETH

Bitcoin NFTs are struggling:

• Taproot Wizards: -4%

• Quantum Cats: -33%

Punk6529’s new voting system for The Memes could revolutionize meme culture by introducing “TDH” (Time Held, Differentiation, Quantity) to decentralize governance.

Memecoins are surging! DOGE, SHIBA, PEPE, and BONK are all up 5-10%, fueled by renewed speculation.

Are we entering another memecoin supercycle?

Key Takeaways

• Bitcoin is holding strong at $84K, with altcoins showing signs of a breakout.

• Circle’s IPO and TradFi’s involvement could drive mainstream crypto adoption.

• Trump’s tariffs and the U.S. debt crisis may push more investors to Bitcoin as a hedge.

• DeFi is evolving with Sonic, Mantle, and Jupiter making major upgrades.

• $117M token unlock on April 3 could lead to short-term volatility.

Future Outlook

• If Bitcoin stays above $80K, altcoins could see more upside.

• Stablecoin competition will heat up as USDC adoption grows.

• More institutional capital could flow into crypto through ETFs and new financial products.

• Will Q2 bring a full-blown bull run, or is another correction ahead?

What are you most excited about this week? Let’s discuss in the comments!

For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok. Subscribe to our newsletter for expert analysis and join our WhatsApp channel to continue the conversation.

This article is for educational purposes only and should not be considered financial advice. Always conduct your own research (DYOR) before making any investment decisions.