Crypto’s Wild Start to 2025: Trump’s Pro-Crypto Push, Solana’s Surge, and a $3.76T Market Cap! What’s Next?

Is crypto about to go mainstream like never before?

January 2025 delivered one of the most eventful months in recent blockchain history, with market movements, political shifts, and DeFi breakthroughs shaping the space. From President Trump’s executive orders favoring digital assets to Solana’s continued dominance over Ethereum, the landscape is rapidly evolving.

Binance Research’s latest report provides deep insights into these market trends, and in this edition of our weekly crypto recap, we break down:

• The impact of Trump’s pro-crypto policies on the market

• Why Solana is outperforming Ethereum in DeFi and NFT trading

• How the crypto market rebounded to $3.76T and what’s next

• The state of NFTs, DeFi, and memecoin mania

• Upcoming token unlocks and major events to watch for in February

Let’s get into the details!

Crypto Market Recap: January 2025 in Review

The crypto market kicked off the year with an explosive rally, reaching a total market capitalization of $3.76T on January 7, before experiencing turbulence later in the month.

Trump’s Pro-Crypto Policies Are Reshaping the Market

The biggest catalyst? President Trump’s executive orders, which signaled the most significant U.S. government shift toward crypto adoption. Key highlights include:

• The creation of a national crypto reserve task force

• A ban on a U.S. Central Bank Digital Currency (CBDC)

• Proposed elimination of capital gains tax on U.S.-issued cryptocurrencies (a move supported by Eric Trump)

These developments sparked a surge in optimism, leading to Bitcoin (BTC) climbing 11.7% and XRP skyrocketing 47.8%, fueled by record-breaking volume on its native DEX.

Real-World Impact: Imagine a future where crypto transactions in the U.S. are tax-free, this could dramatically increase adoption and push Web3 into the mainstream. If capital gains tax on crypto is removed, expect a wave of institutional and retail investors entering the space.

However, not everything was bullish. By late January, market momentum slowed as concerns over DeepSeek AI’s low-cost efficiency model raised fears of tech overvaluations, triggering a sell-off.

What’s Next? Investors are watching for more regulatory clarity, as Trump’s administration could set the tone for global crypto policies.

Solana Continues to Outpace Ethereum in DeFi & NFTs

Solana (SOL) had another record-breaking month, posting a 24.7% price increase and surpassing Ethereum in DEX trading volume for the fourth consecutive month.

Key Drivers of Solana’s Growth

• Memecoin Mania: The launch of $TRUMP and $MELANIA tokens drove a 320% spike in Solana’s DEX activity. Since its debut, the $TRUMP token alone has fueled over $11B in trading volume and 300M daily transactions on the network.

• Lower Fees & Faster Transactions: Solana’s high throughput and near-zero fees make it the go-to chain for traders.

• TVL Surge: Solana’s Total Value Locked (TVL) rose 35% to a record $12.1B, with platforms like Jito, Raydium, and Kamino leading the charge.

Ethereum Struggles: ETH declined 8.2%, losing ground to Solana as traders flocked to cheaper and faster alternatives.

Is Ethereum Losing Its Edge? While ETH remains dominant in institutional DeFi, Solana’s rise indicates a shifting narrative, especially in retail trading and memecoins.

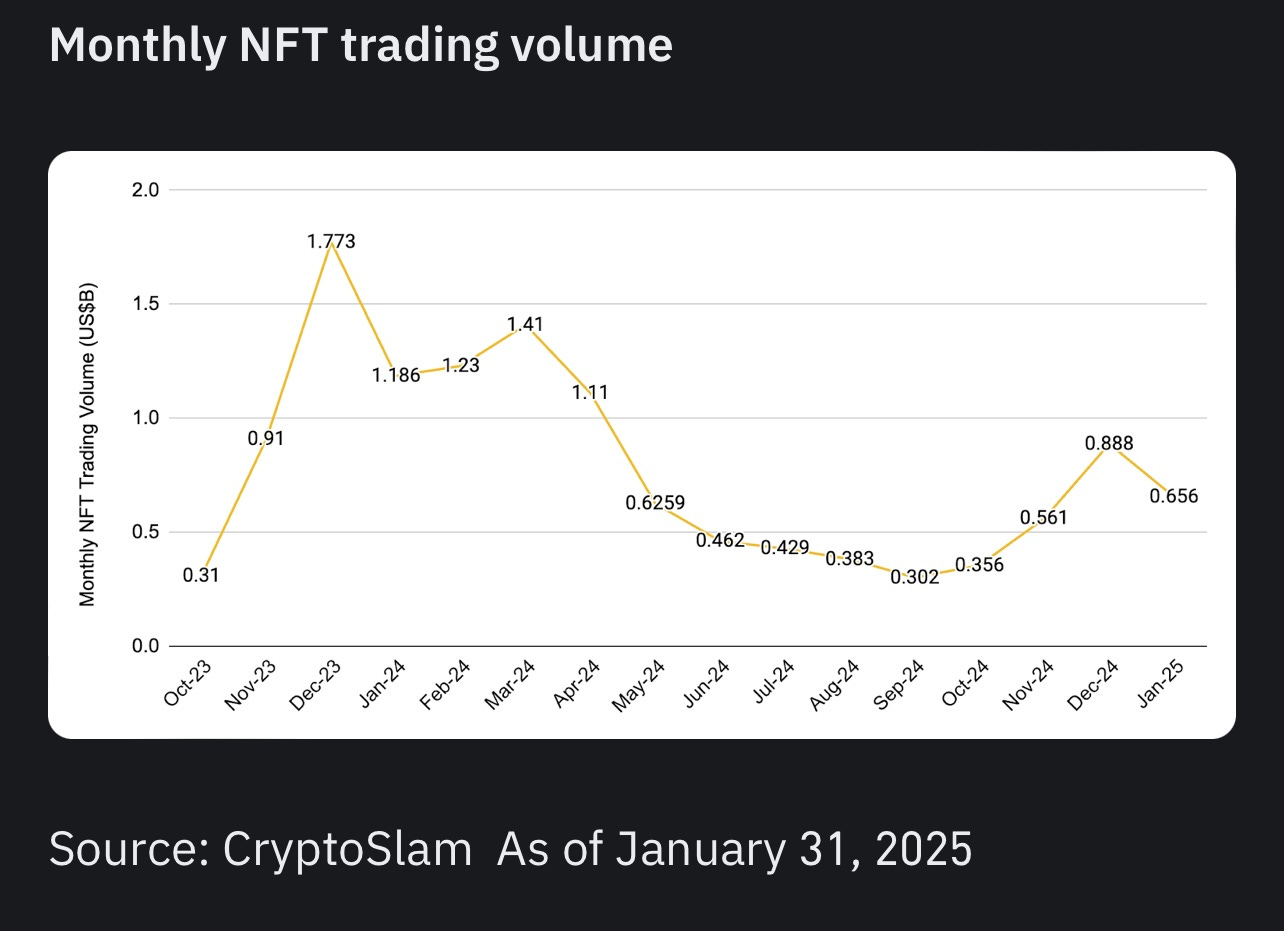

NFT Market Crash: Is the Hype Fading?

The NFT market faced a sharp decline in January, with total sales volume down across major blockchains:

• Ethereum NFT sales dropped 39.1%

• Bitcoin Ordinals fell 39.2%, with projects like Quantum Cats plummeting 65.3%

• Polygon (-70.6%) and BNB Chain (-84.5%) saw some of the steepest declines

However, newer projects like Courtyard (+53%) are still seeing growth, indicating that niche sectors remain resilient.

Real-World Example: The decline in blue-chip collections like Bored Ape Yacht Club (-18.5%) and CryptoPunks (-8.4%) signals a shift from high-end speculation to utility-driven NFTs. Expect gaming, tokenized assets, and AI-powered collections to take the lead in 2025.

DeFi Market Trends: Regulatory Uncertainty & Stablecoin Growth

Despite the market’s overall excitement, DeFi only saw a modest 0.4% TVL increase, mainly due to regulatory uncertainty.

Key Updates:

• The U.S. Treasury finalized rules requiring DeFi platforms to comply with broker regulations. Front-end DeFi providers must report transaction details, with compliance deadlines set for 2025 (custodial brokers) and 2027 (DeFi providers).

• The stablecoin market cap grew 6% to $217B, showing a shift toward low-risk assets amid market volatility.

What This Means: More regulations could push DeFi towards decentralized and privacy-focused solutions, similar to what we saw with DEX growth post-FTX collapse in 2022.

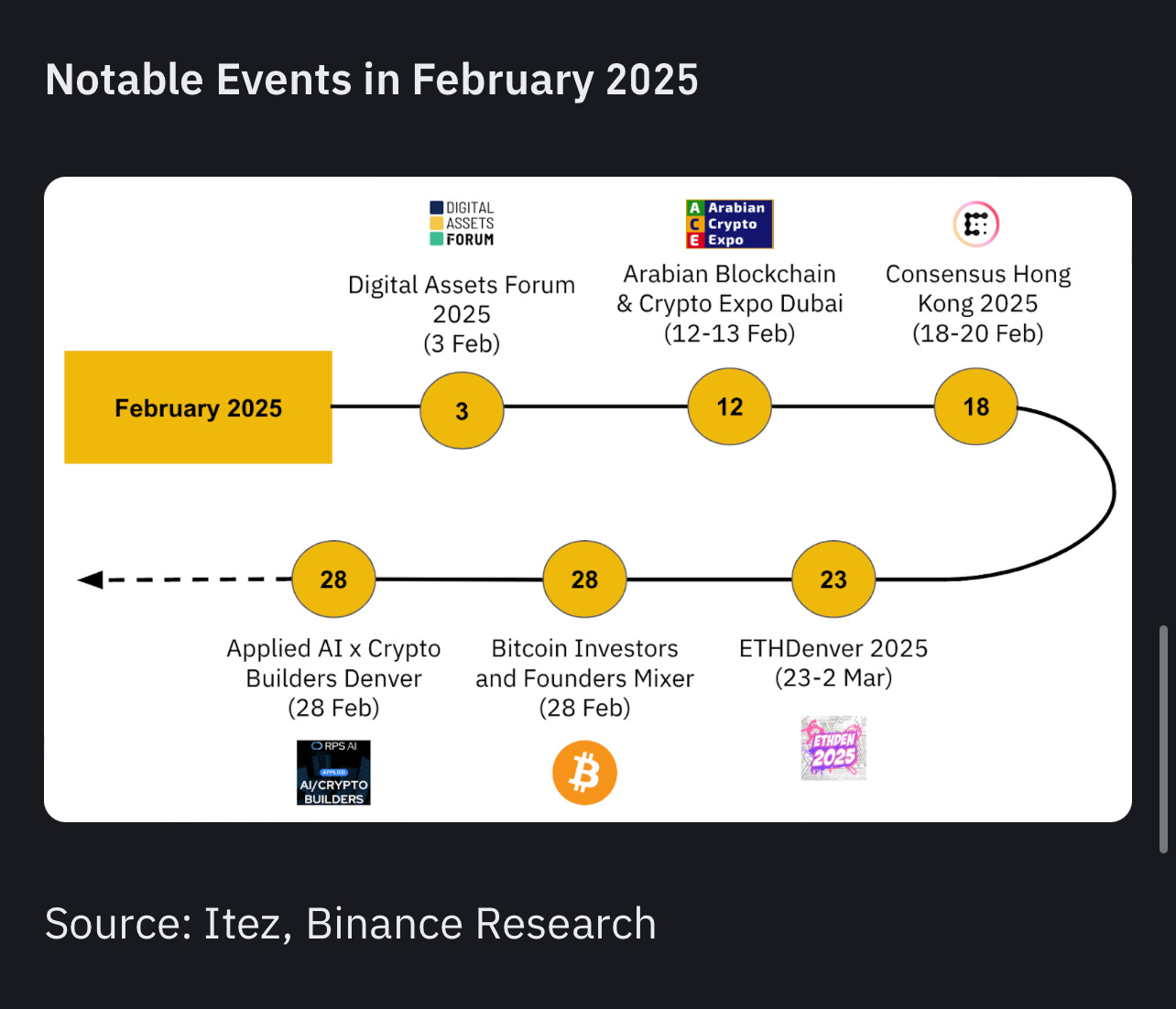

Notable Events & Token Unlocks for February

Staying ahead of the market means knowing key unlocks and events. Here are some major ones to watch:

Token Unlocks:

• Aptos (APT): $250M worth of tokens unlocking

• Optimism (OP): $190M unlock

• Arbitrum (ARB): $120M unlock

Key Events:

• Ethereum’s Dencun Upgrade (Brings cheaper Layer 2 transactions)

• Bitcoin Halving Hype Begins (Expected in April, but speculation is already driving volatility)

Key Takeaways

• Trump’s pro-crypto stance is reshaping the industry, with policies that could fuel institutional adoption.

• Solana is dominating DeFi and NFTs, leaving Ethereum struggling to keep up.

• The NFT market saw a sharp decline, but new utility-driven projects are thriving.

• DeFi is facing regulatory headwinds, pushing innovation towards privacy-focused solutions.

• Major token unlocks and upgrades in February could introduce new market opportunities.

Future Outlook: Where Is Crypto Heading Next?

The next few months will be critical for crypto’s mainstream adoption. If Trump follows through with pro-crypto policies, we could see:

• A surge in U.S. institutions entering the crypto space

• More ETF approvals and regulatory clarity

• Mass adoption of memecoins and decentralized finance solutions

However, macroeconomic factors like interest rates and AI-driven disruptions will continue to introduce volatility.

Join the Conversation & Stay Updated

Crypto moves fast, don’t get left behind! Stay ahead of the trends:

For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok. Subscribe for next week’s crypto breakdown and join our WhatsApp channel to continue the conversation.