Solana vs. Ethereum: Who’s Winning the 2025 Layer-1 War So Far?

Is Solana outperforming Ethereum in 2025? Explore this expert-backed analysis of price performance, trading volume, ecosystem expansion, and market sentiment between SOL and ETH during the first half of the year.

Are we finally witnessing a power shift in the Layer-1 blockchain race?

Is Solana the high-speed challenger gaining enough ground to dethrone Ethereum, the long-reigning king of smart contracts?

In this in-depth blog post, we’ll unpack everything you need to know about Solana vs. Ethereum in 2025. From market performance and trading trends to real-world adoption, DeFi growth, and developer momentum, we’ll help you understand which ecosystem is leading, and more importantly why it matters for you as an investor, builder, or crypto enthusiast.

Buckle up. We’re diving deep into facts, figures, real-world examples, and expert insights that paint a full picture of who’s winning the first half of 2025 and what lies ahead.

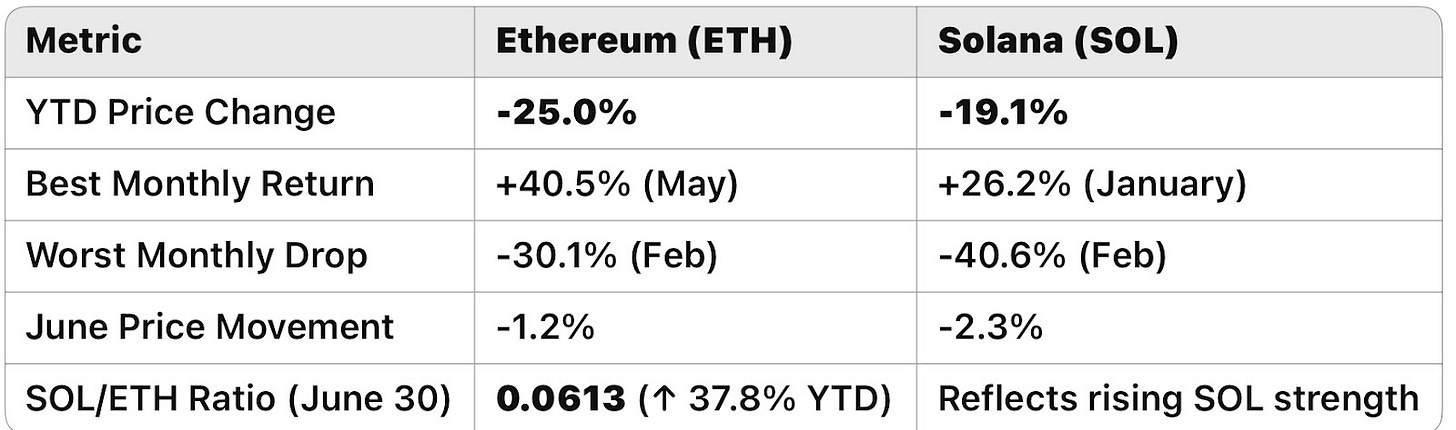

H1 2025: Ethereum vs. Solana at a Glance

Before we explore the narratives, let’s break down the raw performance data.

Despite broader market downturns sparked by Middle East hostilities and macro uncertainty, Solana has shown stronger resilience in both price and ecosystem fundamentals.

Ecosystem Momentum: Solana’s Rising Tide

While Ethereum still leads in Total Value Locked (TVL), Solana is catching up quickly and has far more retail energy, developer momentum, and transaction throughput.

Solana’s Key Drivers

High-Performance Throughput:

Solana processes 100+ million transactions daily, supported by over 500,000 daily active wallets.DEX & DeFi Dominance:

Platforms like Jupiter, Meteora, Kamino, and Raydium have gained huge traction. For example, Meteora surpassed $750M in TVL as of June 2025.Retail-Fueled Hype:

January’s memecoin boom (e.g., TRUMP, MELANIA) boosted engagement and trading volume, peaking at $239.4B in SOL trades that month.Builder Ecosystem & Grants:

Solana’s hackathons and quarterly builder incentives are onboarding a new wave of developers, especially for DeFi and NFT infrastructure projects.

Real-Life Case Study:

After launching during Q1’s memecoin surge, the MELANIA token saw over $80M in trading volume within its first week, with over 30,000 unique wallets interacting on Solana DEXs far outpacing comparable activity on Ethereum-based tokens.

Ethereum: Still Dominant, But Cracks Are Showing

Ethereum still holds the institutional crown but its dominance is being challenged.

Ethereum’s Strengths

Institutional Trust:

Ethereum remains the de facto smart contract platform for major DeFi protocols, enterprise adoption, and NFT infrastructure.May Rebound (+40.5%):

Driven by optimism around upcoming Ethereum upgrades, ETH saw a massive rally, its only green month in H1.Long-Term Ecosystem Depth:

With decades of developer tooling and adoption, Ethereum remains foundational for many Web3 ecosystems.

Ethereum’s Weak Points

High Gas Fees:

Continued complaints and cost barriers are deterring retail and smaller traders.Slower Retail Engagement:

DEX usage, wallet activity, and memecoin interest were significantly lower than on Solana in Q1–Q2 2025.Stagnant Volume Growth:

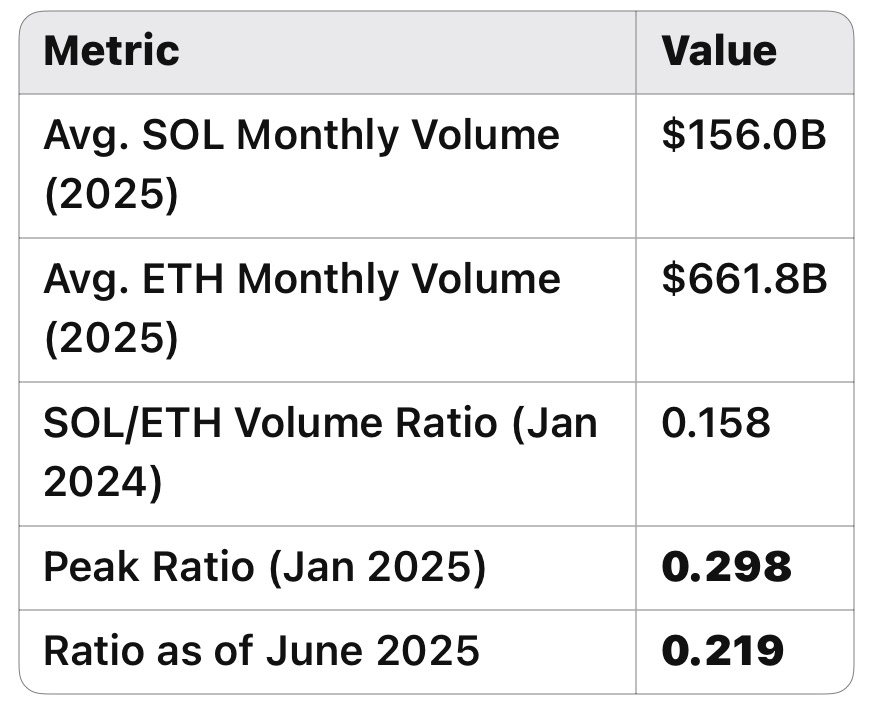

ETH saw a modest 9.7% increase in average monthly volume YoY (from $603B to $661.8B), while Solana jumped 25.4%.

Example:

A small NFT mint costing $1.25 in gas on Solana would have cost over $25 on Ethereum in March 2025, pushing new creators to favor Solana’s lower-cost model.

Trading Volume Trends: Solana Gains the Upper Hand

The SOL/ETH trading volume ratio tells a compelling story of momentum.

While trading volume has cooled since January’s memecoin frenzy, Solana’s growth is outpacing Ethereum’s consistently a trend supported by expanding on-chain engagement and lower trading frictions.

Capital Rotation & Sentiment Shift

Between price performance, user growth, and volume flows, it’s clear:

Investors are rotating into Solana especially retail and high-frequency traders while Ethereum remains favored by institutions.

As of June, the SOL/ETH price ratio stood at 0.0613, up 37.8% YTD and 52.9% from January to April. Even after Ethereum’s May rebound, Solana is maintaining its lead in relative terms.

Key Takeaways

Solana Outperformed Ethereum in H1 2025

Despite volatility, SOL showed stronger price action and ecosystem resilience.

Retail Momentum Drove Solana’s Growth

From memecoins to DEXs, Solana captured the majority of retail buzz.

Ethereum Still Rules Institutions

ETH remains the go-to for major DeFi and enterprise protocols but faces usability challenges.

SOL Gaining Ground in Developer Adoption

Hackathons, grants, and lower-cost execution are attracting new devs.

Capital Rotation is Real

The rising SOL/ETH price and volume ratios point to sustained interest in Solana.

Future Outlook: What’s Next for Solana & Ethereum?

Both ecosystems are poised for pivotal moments in H2 2025.

Ethereum Predictions

Scalability Upgrades: If successfully rolled out, ETH upgrades could re-energize network activity.

Institutional Capital: Likely to maintain dominance in high-capital DeFi protocols.

Solana Predictions

Continued Retail Expansion: With low costs and fast throughput, Solana will likely stay dominant for smaller users.

Protocol Maturity: Platforms like Jupiter and Kamino are gaining polish, attracting more serious DeFi users.

Developer Migration: Expect even more Ethereum-native teams to port to Solana for speed and UX.

Actionable Tips for Investors & Builders

Developers:

Start building on Solana to tap into incentive grants and gain early user traction.

Traders:

Watch the SOL/ETH ratio and volume trends, it’s a useful signal of market sentiment shifts.

Investors:

Diversify exposure across both ecosystems. While Ethereum offers blue-chip stability, Solana offers high-growth potential.

Project Creators:

Consider launching memecoins, NFTs, or DeFi apps on Solana for faster adoption and lower costs.

Conclusion: The Layer-1 Race Is Getting Real

In the battle of Solana vs. Ethereum, there is no single “winner” yet but Solana is winning Round 1 in 2025. It’s growing faster in trading volume, outpacing ETH in price resilience, and capturing the imagination of retail, builders, and emerging Web3 users.

Whether Ethereum reclaims its edge or Solana keeps the crown depends on who adapts faster to user needs in a shifting crypto landscape.

What Do You Think?

Will Ethereum’s upgrades turn the tide in H2 2025, or is Solana the future of Layer-1 dominance?

Drop your thoughts in the comments. 👇 Let’s start a conversation.

Sources & References:

Market data and trading volume statistics obtained from CoinGecko, accessed July 2025. All pricing, ratio, and volume insights are based on publicly available data on CoinGecko’s historical charts and analytics dashboard.

Subscribe to our newsletter for expert analysis and join our WhatsApp channel to continue the conversation. For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok.

This article is for educational purposes only and should not be considered financial advice. Always conduct your own research (DYOR) before making any investment decisions.