Stablecoins: Transforming Global Business and Finance in 2024

Discover how stablecoins like USDC and USDT reshaped finance in 2023, outpacing payment giants, driving DeFi innovation, and unlocking global business opportunities.

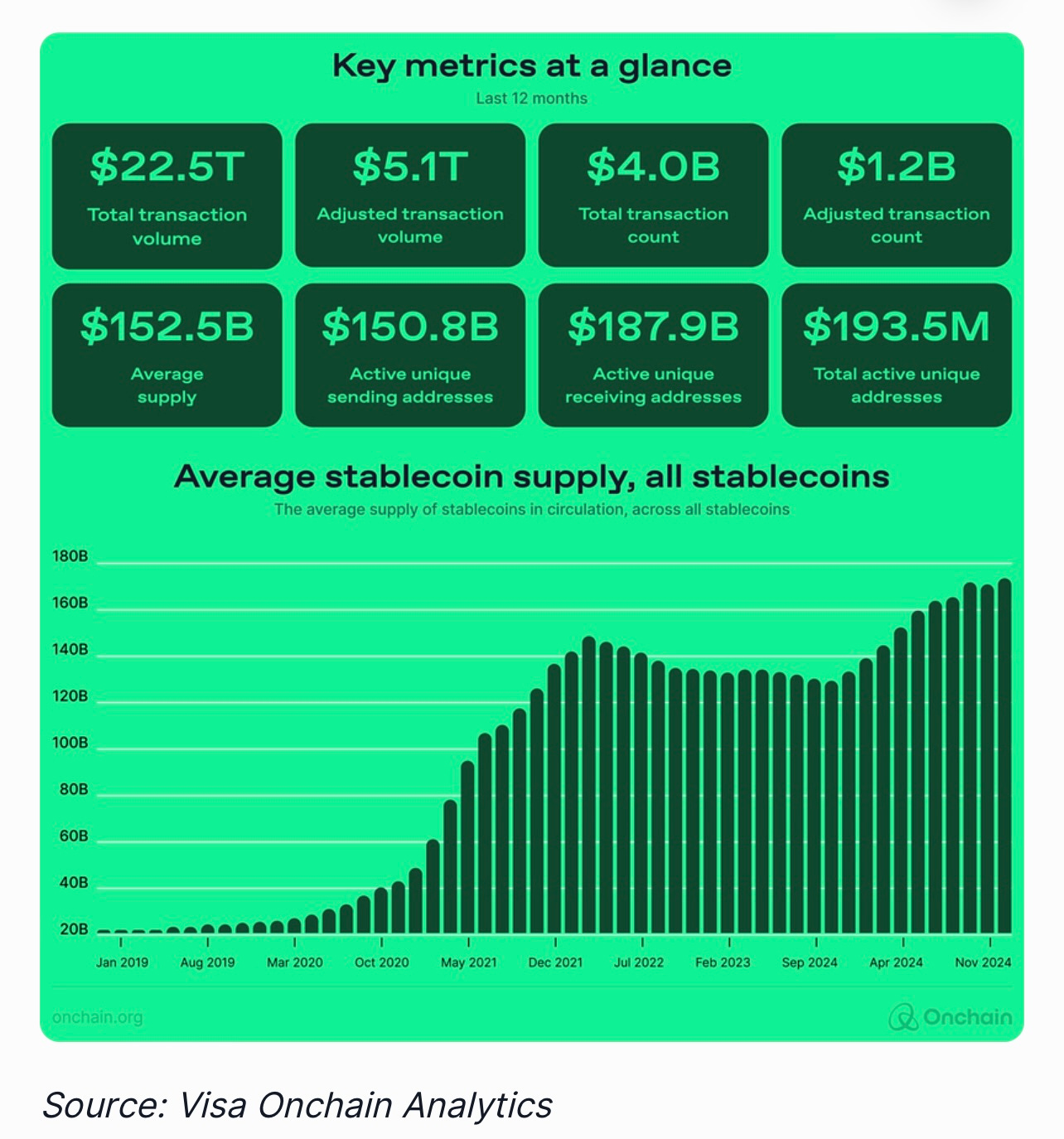

Stablecoins are no longer just a crypto niche, they’ve grown into trillion-dollar engines reshaping the financial landscape. From eclipsing traditional payment giants like Visa and Mastercard to becoming essential assets in decentralized finance (DeFi), stablecoins have found their product-market fit in ways even Central Bank Digital Currencies (CBDCs) have struggled to match.

What started as a niche cryptocurrency for maintaining price stability has blossomed into a powerful tool for businesses, governments, and individuals alike. Stablecoins, such as USDC and USDT, are reshaping the way businesses approach payments, revenue generation, cross-border transactions, and economic inclusivity.

In this blog post, we will explore how stablecoins are revolutionizing payments, revenue models, cross-border transactions, and financial inclusivity, offering practical insights for businesses across Web2 and Web3 ecosystems.

The Core Benefits of Stablecoins

Scalable Revenue Models

One of the most compelling reasons businesses should consider integrating stablecoins is their ability to drive scalable revenue. Stablecoins like Tether (USDT) and Circle (USDC) have shown how powerful this asset class can be. For instance, Tether generated over $6.2 billion in revenue in 2023, largely from interest on its reserves and transaction fees. With $62 million in revenue per employee, Tether’s performance vastly outstrips many leading tech companies, making it clear that stablecoins can provide a sustainable and profitable business model.

Example:

PayPal, a global leader in online payments, made a significant leap into the stablecoin ecosystem by launching PYUSD, a stablecoin backed by US dollars. With over 430 million users worldwide, PayPal’s integration of PYUSD showcases the immense potential of stablecoins to redefine digital transactions.

Key Advantages of PayPal’s PYUSD:

1. Frictionless Transactions: By introducing PYUSD, PayPal enables seamless peer-to-peer payments and digital commerce without the high fees or delays often associated with traditional banking systems.

2. Global Accessibility: PYUSD provides users with a stable digital asset that can be used across borders without the volatility of cryptocurrencies like Bitcoin or Ethereum. This opens new opportunities for users in emerging economies where local currencies may be unstable.

3. Enhanced User Experience: PayPal’s integration of PYUSD eliminates intermediaries in the transaction process, making it more cost-effective and efficient for businesses and consumers alike.

Significance for Businesses:

For the millions of businesses using PayPal, PYUSD offers a more predictable and scalable payment system. For instance, small and medium-sized enterprises (SMEs) can reduce their dependence on traditional payment processors, which often come with high fees and long settlement periods.

Stripe, a major payment processing platform known for powering ecommerce and subscription services, has adopted USDC (USD Coin) to enhance its offerings. This move signifies how stablecoins are becoming integral to mainstream financial systems.

Core Benefits of Stripe’s Stablecoin Integration:

1. Cost Efficiency: Traditional cross-border payment systems often involve high fees and currency conversion costs. With USDC, Stripe enables businesses to process payments at a fraction of the cost.

2. Instant Settlement: USDC transactions are settled in real-time, reducing delays in accessing funds. This is particularly valuable for international businesses that need faster liquidity.

3. Web3 Compatibility: Stripe’s support for USDC bridges the gap between traditional finance (Web2) and the decentralized finance (Web3) ecosystem. It enables businesses to interact with blockchain-based applications and services seamlessly.

Why PayPal and Stripe’s Stablecoin Integration Matters

The adoption of stablecoins by payment giants like PayPal and Stripe signals a pivotal shift in the financial industry. These integrations are not merely experiments; they are strategic moves that showcase the scalability, efficiency, and inclusivity that stablecoins bring to digital payments.

Expanding Opportunities in Emerging Economies

Stablecoins are also a game-changer for emerging economies where inflation, currency devaluation, and lack of access to traditional financial services are pressing issues. In places like Argentina, Turkey, and Nigeria, stablecoins are used as a hedge against local currency volatility, offering stability and global accessibility, stablecoins empower individuals and businesses in ways that traditional systems cannot.

Example 1:

Nigeria – A Financial Lifeline Amid Inflation In Nigeria, economic challenges such as rapid inflation and the devaluation of the Naira have created an urgent need for alternative financial solutions. Stablecoins like USDT and USDC have stepped in to provide stability and global financial access for individuals and businesses.

Financial Inclusion for Consumers:

According to Cointelegraph, 45% of Nigerian consumers use stablecoins, a stark contrast to the 17% adoption rate in developed nations. This high adoption rate is driven by the need to hedge against local currency devaluation.

How It Works:

Nigerians convert their earnings or savings into stablecoins like USDT to preserve purchasing power. With inflation rates exceeding 20% in 2023, this is a critical tool for financial survival.

Empowering Businesses:

Stablecoins enable Nigerian businesses to overcome the inefficiencies of the local banking system, particularly for cross-border transactions.

Example:

A Nigerian e-commerce entrepreneur selling goods internationally can receive payments in USDC, bypassing high conversion fees and long delays imposed by local banks. This efficiency reduces costs and improves cash flow, making businesses more competitive globally.

Example 2: Remittances in Latin America – Affordable and Transparent Solutions

Latin America has long faced challenges in remittances, where fees charged by traditional money transfer services often exceed 7% of the amount sent. Stablecoins like USDC are changing the game by offering fast, low-cost, and transparent solutions.

Transforming the Remittance Landscape:

Stablecoins eliminate the need for intermediaries like banks and remittance services, reducing costs and increasing transaction speeds.

Example:

Platforms like Bitso, a leading crypto exchange in the region, enable users to send USDC for a fraction of the cost charged by traditional services. For families in Mexico and Argentina receiving remittances, this means more money in their hands, faster than ever before.

Addressing Financial Challenges:

In countries like Argentina, where inflation rates hover around 100%, stablecoins provide a lifeline for families relying on remittances.

Example:

A worker in the United States can send money to family members in Argentina via USDC through Bitso. The recipients can hold the funds in stablecoins to preserve value or easily convert them to local currency when needed, avoiding significant losses due to devaluation.

As adoption grows in regions like Nigeria and Latin America, stablecoins are proving their potential to transform financial systems and empower individuals and businesses globally.

Building on the efficiency of stablecoins:

Beyond revenue generation, stablecoins are improving operational efficiencies. Stablecoins reduce transaction fees, shorten processing times, and eliminate intermediaries in financial transactions. By integrating stablecoins into business operations, companies can dramatically reduce the costs associated with traditional banking systems, especially in cross-border payments.

Reduced Transaction Fees and Processing Times

Traditional financial systems are often burdened by high fees and lengthy processing times, particularly for cross-border transactions. Stablecoins offer a solution:

Cost Reduction: Stablecoin transactions typically incur minimal fees compared to the 2%-5% charged by traditional payment processors or the high costs of SWIFT transfers for cross-border payments.

Example:

A small e-commerce business in Asia receiving payments from customers in the United States can save thousands annually by switching from PayPal’s traditional processing to USDC-based payments on blockchain networks.

Faster Settlements: Traditional wire transfers can take days to process, especially across time zones. Stablecoins enable near-instant settlements, reducing delays and improving cash flow management.

Example:

A global supplier using stablecoins for payments can settle transactions in seconds, enabling them to immediately reinvest or restock inventory.

Facilitating Cross-Border Payments and Global Trade

Stablecoins are becoming essential in global trade by simplifying cross-border payments.

• Access to Global Markets: Stablecoins remove barriers to entry for businesses in developing countries, enabling them to transact with partners or customers worldwide.

Example:

A digital marketing agency in India working with international clients receives stablecoin payments, avoiding costly conversion fees and lengthy processing times.

Enhancing Supply Chain Efficiency: Stablecoins streamline supply chain payments, ensuring faster and more reliable payments to suppliers.

Example:

A multinational corporation paying suppliers in Southeast Asia with USDT can eliminate delays caused by bank holidays or cross-border banking restrictions.

Supporting Payroll and Employee Compensation

Stablecoins are being increasingly used to pay employees, particularly in remote and freelance roles.

Seamless Payroll: Companies can pay employees worldwide with stablecoins, ensuring timely payments regardless of location.

Strategic Advantages Over Traditional Finance and CBDCs

One of the most notable advantages of stablecoins over traditional fiat currencies and Central Bank Digital Currencies (CBDCs) is decentralization. Unlike CBDCs, which are centralized and controlled by governments, stablecoins give businesses and individuals greater autonomy over their financial transactions. Stablecoins enable cross-border interoperability and offer greater privacy, avoiding the regulatory scrutiny associated with traditional financial systems.

Example: Decentralized Finance (DeFi)

Stablecoins are foundational to the DeFi (Decentralized Finance) ecosystem. Platforms like Aave and MakerDAO use stablecoins to offer lending, borrowing, and yield-generation opportunities. These decentralized protocols allow businesses and individuals to access financial services without relying on traditional financial institutions, creating new opportunities for growth.

Examples: How Businesses Are Leveraging Stablecoins

The adoption of stablecoins spans a variety of industries and business models. Beyond fintech giants like PayPal and Stripe, several other companies have successfully integrated stablecoins into their operations:

•Facebook’s Diem Project (formerly Libra): A prime example of how a tech giant envisioned using a stablecoin for global financial inclusion.

•eCommerce and Payment Processing: Shopify and BigCommerce have allowed merchants to accept stablecoin payments, expanding their global reach and improving payment efficiency.

•Gaming and NFTs: Companies like Axie Infinity use stablecoins as in-game currency, enabling users from countries with unstable currencies to participate in the global gaming economy.

•Cross-Border Payments: Companies like Ripple use stablecoins to facilitate faster, more affordable international money transfers. Ripple’s use of XRP as a bridge currency has reduced cross-border transaction times from several days to just a few minutes, saving businesses time and money.

•Supply Chain and Logistics: VeChain is using blockchain and stablecoins to revolutionize supply chain logistics. By using blockchain technology and stablecoins, businesses can track the origin of goods, reduce fraud, and facilitate instant payments to suppliers worldwide.

These examples highlight how stablecoins are being leveraged across various sectors to solve real-world problems and improve business operations.

Example: DeFi Platforms and the Growth of Decentralized Finance

Stablecoins form the backbone of the DeFi ecosystem. Platforms like MakerDAO, Compound, and Yearn Finance rely heavily on stablecoins to facilitate lending, yield farming, and borrowing. These decentralized protocols enable businesses and individual users to earn interest on their stablecoin holdings or take out loans without the need for traditional financial intermediaries, providing more flexibility and better financial returns compared to centralized options.

Stablecoins also facilitate cross-border transactions with minimal friction. For example, USDC is now supported across numerous blockchain platforms, including Ethereum, Solana, and Avalanche, allowing users to transact seamlessly across different networks without the barriers of traditional finance.

Challenges and Risks to Consider

While stablecoins present numerous advantages, they also come with challenges and risks that businesses and individuals must navigate carefully. Below, we outline these challenges and provide actionable strategies to address them, ensuring a practical approach to adopting stablecoins.

Regulatory Uncertainty

The Challenge:

One of the most significant barriers to adopting stablecoins is the lack of clear regulations. Governments and financial regulators are still debating how stablecoins fit into existing financial frameworks. For businesses, this creates uncertainty about compliance and potential legal repercussions.

Example:

In the United States, regulatory bodies like the SEC and Commodity Futures Trading Commission (CFTC) are debating whether stablecoins should be treated as securities, commodities, or something else entirely. Meanwhile, the European Union’s Markets in Crypto-Assets (MiCA) regulation aims to provide clarity for stablecoins across member states.

Suggestions:

• Stay Informed on Regulatory Updates:

Businesses should actively monitor updates from local and international regulatory bodies to stay compliant. Partnering with legal advisors or consultants specializing in crypto regulation can provide clarity.

Tip: Follow the latest developments from organizations like the Financial Action Task Force (FATF), the SEC, and MiCA to anticipate changes in compliance requirements.

• Engage in Industry Advocacy:

Join industry groups or associations that advocate for balanced crypto regulations, such as the Blockchain Association or the Global Digital Finance (GDF) initiative. Collective lobbying can help shape favorable policies.

• Adopt Flexible Business Models:

Design business models that can adapt to different regulatory environments. For example, consider integrating stablecoins that comply with specific jurisdictions, such as USDC for U.S.-based transactions or MiCA-compliant tokens for the European market.

Security Risk: Safeguarding Digital Assets

The Challenge:

As with all digital assets, stablecoins are susceptible to cyberattacks, hacking, and fraud. Businesses using stablecoins must ensure that wallets, private keys, and transaction processes are secure.

Example:

In 2021, a decentralized finance (DeFi) platform lost over $600 million in a hacking incident, highlighting vulnerabilities in the crypto ecosystem. Although stablecoins themselves may be stable, their use within insecure platforms can lead to significant losses.

Suggestions:

• Invest in Robust Cybersecurity Measures:

Use secure, insured custodial wallets or reputable hardware wallets to store stablecoins. Platforms like Ledger and Trezor offer hardware wallets designed for high security.

Tip: Implement multi-signature wallets to require multiple approvals for transactions, reducing the risk of unauthorized access.

• Educate Employees and Partners:

Train teams on best practices for handling stablecoins, including recognizing phishing attempts and securely storing private keys.

Example: Require employees to use password managers and two-factor authentication (2FA) for wallet access.

• Partner with Trusted Providers:

Use stablecoins issued by reputable organizations such as Circle (USDC) or Paxos (USDP), which undergo regular audits and maintain high-security standards.

Market Competition: Standing Out in a Crowded Space

The Challenge:

The stablecoin market is rapidly growing, with numerous entrants vying for dominance. Businesses must differentiate themselves and create unique value propositions to succeed in this competitive space.

Example:

Tether (USDT) and Circle’s USDC dominate the market, but newer entrants like PayPal’s PYUSD aim to carve out their niche by leveraging existing customer bases and providing seamless integrations.

Suggestions:

• Focus on Differentiation:

Identify unique use cases or underserved markets. For instance, a stablecoin tailored for remittance services in Southeast Asia could gain traction by addressing region-specific needs.

• Leverage Partnerships:

Collaborate with existing platforms, such as e-commerce companies, DeFi protocols, or payment processors, to expand stablecoin adoption.

Example: PayPal’s PYUSD is integrated into its vast ecosystem, giving it a competitive edge.

• Enhance User Experience:

Simplify onboarding for users by providing intuitive interfaces, transparent fee structures, and educational resources.

Tip: Develop mobile-friendly wallets that are easy to use, even for individuals with limited technical expertise.

Future Outlook:

The Role of Stablecoins in the Future of Finance

Stablecoins are positioning themselves to be a core part of the financial infrastructure in the Web3 and decentralized finance ecosystems. As adoption increases, stablecoins will likely integrate with traditional financial services, paving the way for a more seamless digital economy.

Projections:

•The global market for stablecoins is expected to reach $10 billion by 2025, with continued adoption in remittances, payments, and cross-border trade.

•CBDCs will likely coexist with stablecoins, enabling interoperability between decentralized and centralized systems.

Conclusion How to Capitalize on Stablecoins Today

The opportunities presented by stablecoins are transformative, offering businesses new ways to innovate, streamline operations, and tap into global markets. From creating modern business models to enhancing efficiencies and driving financial inclusion, stablecoins have positioned themselves as a cornerstone of the Web3 economy.

To fully capitalize on these benefits, businesses should act now by integrating stablecoin payment options, collaborating with DeFi platforms, and exploring innovative use cases tailored to their specific industries. Stablecoins are not just a trend; they are a pivotal tool for staying competitive in the rapidly evolving digital economy.

Key Takeaways:

• Revenue Generation: Stablecoins enable businesses to build new income streams through payment systems, lending protocols, and cross-border transactions.

• Operational Efficiency: By reducing transaction fees, speeding up settlements, and eliminating intermediaries, stablecoins streamline business processes.

• Global Financial Access: In emerging markets like Nigeria and Latin America, stablecoins provide a hedge against inflation, affordable remittance options, and a gateway to global markets.

• Real-World Success Stories: Companies like PayPal, Circle (USDC), and Shopify showcase how stablecoins are reshaping industries and empowering businesses to adopt Web3 technologies.

• Regulatory Clarity: With frameworks like the European Union’s MiCA regulation and the U.S 's evolving policies, stablecoins are becoming safer and more legitimate tools for businesses.

Why the Time to Act is Now

Now is the time for businesses to act. Whether you are part of a traditional business or a Web3-native company, stablecoins offer a clear competitive advantage. Integrate stablecoins into your payments, revenue generation, or financial services to stay ahead of the curve.

Stablecoins are shaping the future of finance and commerce. Businesses that adopt them today are positioning themselves as leaders in tomorrow’s digital economy. Explore stablecoin integrations, educate your teams on their potential, and start building for the future.