US Crypto Rules After the Reset: The 2026 Tests Ahead

A deep dive into US crypto regulation after 2025’s policy reset, exploring stablecoin laws, market structure bills, SEC and CFTC shifts, banking access, and what 2026 will test for Web3 builders, investors, and institutions.

What happens when crypto finally gets rules but the real test hasn’t started yet?

After years of uncertainty, enforcement battles, and regulatory whiplash, the US crypto industry entered 2026 with something it hasn’t had before: direction.

Not perfect clarity. Not full harmony. But momentum.

The close of 2025 marked a historic pivot. Washington moved away from regulation-by-enforcement and toward structured oversight, powered by a White House policy reset, the first-ever federal stablecoin law, and coordinated agency programs designed to pull crypto activity into the regulated perimeter.

This blog post breaks down what actually changed, what will be tested in 2026, and what builders, investors, institutions, and founders should do now to stay ahead.

You’ll walk away understanding:

Where US crypto rules are finally landing

Why 2026 is more important than 2025

How real licensing, supervision, and liability will stress-test the system

The Big Picture: A New US Crypto Rulebook Is Taking Shape

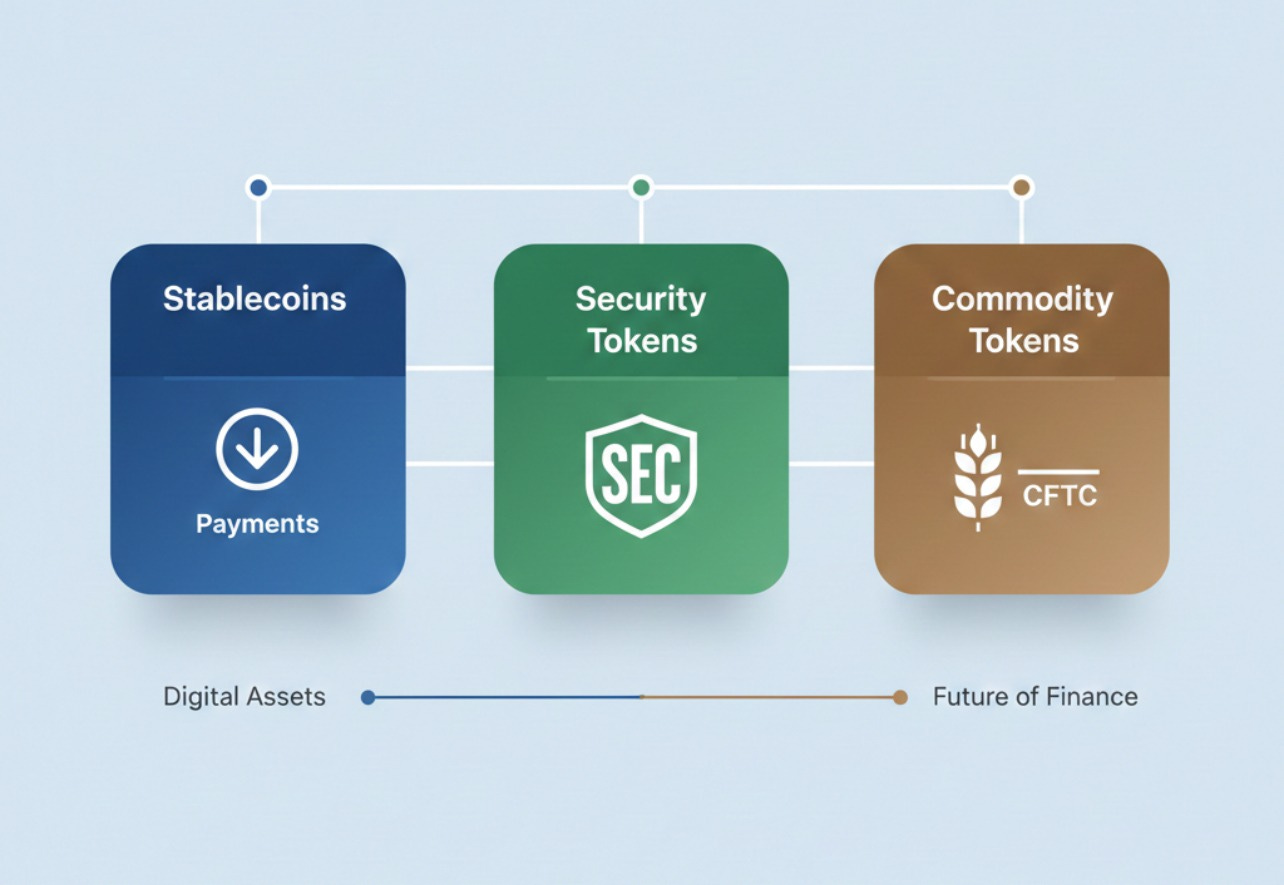

By the end of 2025, US regulators began aligning around a three-part framework:

Stablecoins → Treated as payment infrastructure

Certain tokens → Regulated as securities

Most remaining crypto assets → Likely treated as commodities

This is a massive shift from the previous “everything might be a security” posture.

But here’s the catch 👇

Frameworks are easy. Enforcement, licensing, and supervision are hard.

And that’s exactly what 2026 will test.

1. Market Structure Legislation: The Clock Is Ticking

Window to Watch: January – June 2026

The Digital Asset Market Clarity Act, passed by the House in July 2025, was the most comprehensive crypto market structure bill the US has ever seen.

But it stalled in the Senate.

Why it matters

Without this bill:

Exchanges lack clear registration paths

Broker-dealers face overlapping obligations

Developers operate under legal ambiguity

What’s happening next

When Congress reconvenes in January 2026, momentum resumes.

Key milestones to track:

January 2026: Second session of the 119th Congress begins

Q1 2026: Senate committee markups or revised drafts expected

Before August 2026 recess: Final realistic window for a Senate vote

If nothing passes by mid-2026, comprehensive reform likely slips to 2027, right into midterm election turbulence.

Real-world example

A US-based crypto exchange operating both spot bitcoin trading and tokenized securities currently juggles:

State money transmitter licenses

SEC scrutiny

CFTC uncertainty

A finalized market structure law would determine who regulates what—and how, unlocking nationwide scale.

Actionable takeaway

If you’re a founder or operator:

Map which assets you list could fall under securities vs commodities

Prepare compliance budgets for dual oversight scenarios

Engage legal counsel early 2026 drafts will move fast

2. Stablecoin Rules Under the GENIUS Act

Statutory Deadline: July 2026

The GENIUS Act, signed into law in July 2025, created the first federal framework for payment stablecoins.

This was a watershed moment.

What the law does

Assigns implementation to the US Treasury and banking regulators

Establishes guardrails around reserves, disclosures, and issuers

Sets a one-year clock for final rules

What happens in 2026

By July 2026, Treasury must finalize rules covering:

Reserve requirements (cash, T-bills, liquidity standards)

Disclosure obligations

Treatment of foreign-issued stablecoins

Issuer eligibility and enforcement triggers

Expect proposed rules in Q1 or Q2 2026, followed by a public comment period.

Real-world example

A US fintech issuing a dollar-backed stablecoin for cross-border payments will now need to:

Hold verified reserves

Publish regular attestations

Meet issuer licensing standards

Integrate AML and compliance systems

This pushes stablecoins closer to regulated payment rails, not shadow banking.

Adoption projection

Industry analysts expect regulated stablecoin transaction volume to exceed $5 trillion annually by 2027, driven by:

Remittances

Merchant settlement

Tokenized treasury products

Actionable takeaway

If you build with stablecoins:

Audit your reserve model now

Track Treasury rule proposals closely

Prepare for banking-style examinations

3. SEC Rulemaking and Token Classification

Key Moments: Q1 and Q2 2026

Under new Chair Paul Atkins, the SEC spent 2025 rebuilding trust—quietly.

Instead of lawsuits, the agency focused on:

Task forces

Interpretive guidance

No-action letters

Targeted exemptions

2026 is where theory must become durable rules.

Dates to watch

Early Q1: Proposed rule or guidance on token classification

Spring 2026: More no-action letters and pilot programs

Mid-2026: Possible expansion of crypto ETF listings

A full five-commissioner bench expected sometime in 2026 could accelerate formal votes.

Real-world example

A startup issuing a governance token for a decentralized protocol may finally receive:

Clear criteria for when a token transitions from security → commodity

A safe harbor window for decentralization

Custody clarity for institutional holders

This reduces legal risk without sacrificing investor protection.

Actionable takeaway

For token issuers:

Document decentralization milestones

Separate governance from profit expectations

Engage early with SEC pilot programs

4. CFTC Pilots and the Fight for Spot Market Authority

Live Through 2026

The CFTC entered 2026 with momentum, launching digital asset pilot programs in late 2025.

These pilots allow:

Bitcoin, ether, and stablecoins

To be used as collateral in regulated derivatives markets

Why this matters

It signals institutional confidence and positions the CFTC as the natural home for non-security crypto assets.

What to watch

Ongoing evaluation of collateral pilots

Mid-2026: Expansion or formal rule adoption

Late 2026: Congressional decision on CFTC spot market authority

Leadership counts. Chair Michael Selig’s first full year will define the agency’s ambition.

Real-world example

A hedge fund using bitcoin as collateral for futures trading now operates inside a regulated framework, reducing counterparty risk and unlocking capital efficiency.

Actionable takeaway

If you trade or build derivatives:

Explore CFTC-approved venues

Monitor pilot expansions

Prepare for stricter reporting standards

5. Banking Access and Federal Crypto Charters

Where Regulation Meets Balance Sheets

In December 2025, the OCC issued guidance allowing national banks to engage in:

Crypto custody

Stablecoin activities

Certain settlement services

No prior supervisory approval required.

This is huge.

What to watch in 2026

Q1 2026: First bank-led crypto custody launches

Throughout 2026: Supervisory exams testing real risk treatment

Late 2026: Applications for new trust banks or digital asset charters

Real-world example (step-by-step)

A regional bank integrating crypto custody:

Launches bitcoin and ether custody for HNW clients

Partners with a qualified custodian

Undergoes OCC examination

Expands into stablecoin settlement

This is how crypto enters TradFi; slowly, then all at once.

Actionable takeaway

If you’re a crypto firm:

Build bank-grade compliance

Prepare for audits

Design products that fit existing balance sheet logic

Key Takeaways

Benefits

Regulatory clarity unlocks institutional capital

Stablecoins gain legitimacy as payment infrastructure

Banks re-enter crypto markets

Risks

Delayed legislation could stall innovation

Compliance costs may squeeze smaller players

Fragmented oversight remains a threat

Real-world applications

Tokenized treasuries

Regulated stablecoin payments

Institutional crypto custody

Future Outlook: What Comes After 2026?

By the end of 2026, the US crypto market will likely fall into two camps:

Compliant, scalable, institution-ready platforms

Offshore or marginal players unable to adapt

Expect:

Faster consolidation

Increased M&A

Stronger US leadership in regulated Web3

The winners won’t be the loudest but the most prepared.

Conclusion: The Reset Is Over, Now Comes the Test

2025 reset the tone.

2026 will test the system.

Rules will meet reality.

Frameworks will face friction.

And only serious builders will survive the transition.

If you’re in crypto today, this is your moment to decide:

Will you build inside the system or around it?

Will you wait for clarity or prepare for it?

👉 Founders: Start compliance planning now

👉 Investors: Reassess regulatory risk in your portfolio

👉 Builders: Design with supervision in mind

The next wave of crypto adoption won’t come from chaos, it will come from clarity.

Are you ready for the 2026 tests ahead?

Subscribe to our weekly newsletter Because in crypto, the early informed don’t just adapt, they lead.

join our WhatsApp channel to continue the conversation. For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok.

This article is for educational purposes only and should not be considered financial advice. Always conduct your own research (DYOR) before making any investment decisions.