USD1 Is Booming: How to Buy It, Why It Matters, and What’s Next for the Fastest-Growing Stablecoin

Explore how to buy USD1 on Ethereum, BSC, and HTX, plus what sets it apart in the stablecoin market. Discover real-life examples, adoption stats, airdrop insights, and future projections.

Is This the Next USDT? Everything You Need to Know About USD1, the Stablecoin With Political Backing and Lightning Speed Growth

Have you ever wondered what would happen if a stablecoin launched with the full support of institutions, centralized exchanges, and even political influence?

Meet USD1, the fastest-growing stablecoin in the crypto market today.

In this post, we’ll take you through:

How to buy USD1 on Ethereum, BSC, and centralized exchanges

Why it’s gaining traction faster than most new tokens

The potential airdrop opportunity

What makes USD1 unique (hint: political leverage)

Future predictions for where this stablecoin is headed

Whether you’re a DeFi enthusiast, a governance token holder, or just crypto-curious, this guide will give you clear steps, examples, and expert insights into one of 2025’s most talked-about digital assets.

What Is USD1 and Why Is Everyone Talking About It?

USD1 is a newly launched stablecoin developed by World Liberty Financial, and it’s already making waves across multiple chains and platforms. Unlike other stablecoins like USDC and USDT that grew through mass adoption and ecosystem integration, USD1 is sprinting ahead via exclusive deals, political affiliations, and a bold multi-chain strategy.

Real-World Example:

USD1 has already been listed on HTX (formerly Huobi), a top 10 global exchange, and is being adopted through institutional partnerships like the MGX Binance deal. These kinds of top-down deals are not common for stablecoins this early in their lifecycle.

How to Buy USD1: A Step-by-Step Guide Across Ethereum, BSC & HTX

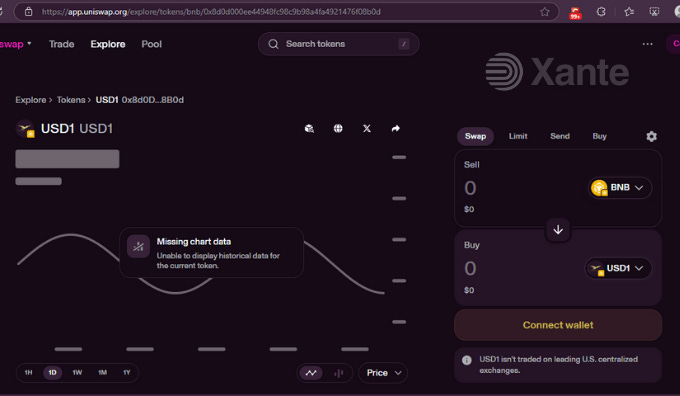

Option 1: Buying USD1 on Ethereum via Uniswap

Real-Life Use Case:

Emeka, a Nigerian crypto trader, used Uniswap to acquire USD1 for his DeFi arbitrage bot that operates on Ethereum mainnet. He followed these exact steps:

Go to: Uniswap

Connect Your Wallet: MetaMask, WalletConnect, or Coinbase Wallet

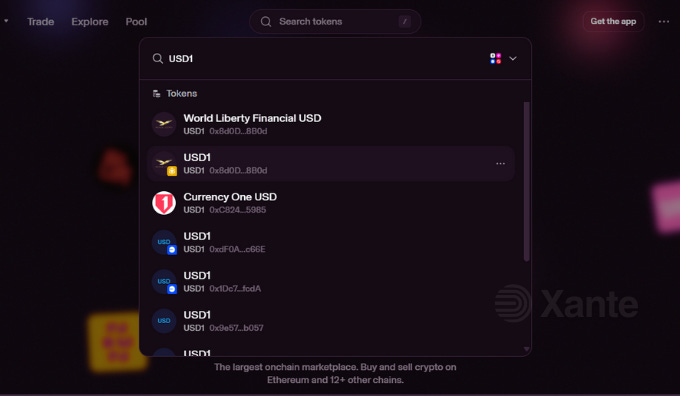

Search for USD1: Or paste the verified contract address (official source only)

Input Amount & Confirm Transaction

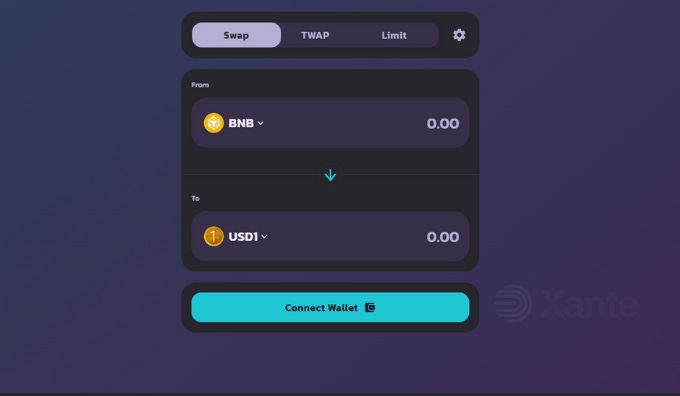

Option 2: Buying USD1 on BNB Chain via PancakeSwap

Pro Tip: Make sure you’re on the BNB Chain and double-check the contract address. The address is the same as Ethereum, which can be confusing and risky if you’re not careful.

Contract Address:

0x8d0d000ee44948fc98c9b98a4fa4921476f08b0d

Steps:

Visit PancakeSwap (link).

Connect your wallet and ensure BNB Chain is selected

Select USD1 by pasting the contract address

Enter the token amount and sign the transaction

Real-Life Case:

An Indonesian investor named Lina used PancakeSwap to convert a portion of her BNB into USD1 as part of her stablecoin yield farming strategy. The identical address across chains initially confused her, but she verified it on BSCScan before proceeding.

Option 3: Buying USD1 on Centralized Exchange (HTX)

HTX (formerly Huobi) recently listed USD1, marking a milestone in USD1’s journey toward mainstream adoption. The USD1/USDT trading pair is live.

Deposits: Open now

Trading: Started May 6, 2025

Withdrawals: Opened May 7, 2025

Why HTX Matters:

Centralized exchanges often offer deeper liquidity than DEXs. This means less slippage and more stable pricing for large trades. However, the current volume on HTX is still catching up compared to PancakeSwap, so always check the order book before making large trades.

The Airdrop Buzz: What We Know So Far

On April 8, 2025, the World Liberty Financial team proposed a one-time test airdrop of USD1 to holders of its governance token, WLFI.

Purpose: Testing airdrop infrastructure and rewarding early supporters

Eligibility/Snapshot Date: Not yet confirmed

Community Sentiment: Overwhelmingly supportive on forums

Actionable Insight:

If you’re holding WLFI, don’t move your tokens yet, snapshot dates often look at wallet history. Stay alert for official updates to secure your spot.

What Makes USD1 Different From USDT or USDC?

USD1 is riding a very different wave than its predecessors.

Key Differentiators:

Political Support: Backed by Trump-era connections, giving it a leg up in deal-making

Strategic Exchange Listings: Fast-tracked to HTX, unlike most new stablecoins

Cross-Chain Uniformity: Same contract address on BSC and Ethereum (rare)

Institutional Deals: Already featured in large-scale integrations (e.g., MGX-Binance)

But is it real demand or political leverage?

That’s still up for debate. While the deals are real, USD1’s retail usage is limited so far. It hasn’t yet become a preferred medium of exchange like USDC on Coinbase or USDT on Binance.

Key Takeaways

USD1 is a multi-chain stablecoin that can be purchased on Uniswap (Ethereum), PancakeSwap (BNB Chain), and HTX (CEX).

Political and institutional backing is helping USD1 scale quickly unlike most grassroots stablecoins.

Liquidity is better on DEXs (for now), but HTX offers a promising future.

A test airdrop is on the horizon for WLFI holders, watch for updates.

Use caution when swapping, double-check contract addresses and chain selections.

Future Outlook: Where Is USD1 Headed?

USD1’s future largely depends on two key factors:

Expansion of Institutional Deals:

If partnerships like MGX-Binance become more frequent, USD1 could challenge USDT’s dominance in certain ecosystems.Real Retail Demand:

Until retail traders begin using USD1 as their go-to stablecoin, it’s unlikely to surpass USDC or DAI in grassroots adoption.

Potential Scenarios:

Best Case: USD1 becomes a politically favored, cross-chain alternative to USDT

Worst Case: It fades if deals stop and real usage doesn’t pick up

Likely Path: Institutional foothold with slow organic retail growth

Conclusion: Is USD1 Worth Watching or Just Another Hype Train?

USD1 is not your average stablecoin. Backed by big names and moving at lightning speed, it’s positioning itself as a serious contender. But with great momentum comes the need for greater caution.

Before diving in:

Do your own research (DYOR)

Verify all contract addresses

Avoid jumping in due to hype alone

That said, USD1 is worth tracking, especially for investors who like to position themselves early.

Want more guides like this delivered weekly?

Subscribe to our newsletter for expert analysis and join our WhatsApp channel to continue the conversation. For daily updates, follow us on all socials; Instagram, Twitter, Telegram, and TikTok.

This article is for educational purposes only and should not be considered financial advice. Always conduct your own research (DYOR) before making any investment decisions.